Fort Lauderdale Small Business Accounting #1 CPA Firm

If there’s any change in your bookkeeping team, we’ll let you know as soon as possible and make sure the transition is a smooth one. Join over 35,000 US-based business owners who have streamlined their finances and have grown their businesses with Bench. Our platform allows you to automate data inputs from most major providers to avoid common mistakes. We partner with merchants like Gusto, Stripe, Shopify, and Square—so your finances are always accurate. In Fort Lauderdale, we guarantee regular updates on your bookkeeping matters.

Fort Lauderdale Bookkeeping Services

Xendoo and the Xero accounting platform work hand-in-hand to integrate seamlessly with virtually all of the cloud software used by Fort Lauderdale small businesses today. Every service to save you money at tax time, with access to a CPA all year. Very few business owners enjoy the bookkeeping side of their business, especially at the end of a long day. We try our best to keep you with the bookkeeping team you’re assigned when you come on board.

Louisdor & Fisher Accounting Services

- Our platform enables Fort Lauderdale, Florida business owners to automate data inputs from the majority of main providers, eliminating common errors.

- Get your bookkeeping, income tax prep, and filing done by experts—backed by one powerful platform.From startups to agencies, Bench works with Fort Lauderdale small businesses.

- You shouldn’t have to wait days for an accountant to return your call.

- No more mad dash to get organized for income tax day, or filing extensions when you fall behind.

- Bookkeeping Services in Fort Lauderdale – An essential service for every business!

- You can customize the package of services you receive by adding payroll, tax planning, tax preparation, or any of our other services.

Our small business certified public accountants will generate an income statement for your business each period as part of our small business accounting/bookkeeping services. We at Howard, Howard and Hodges is a leading small business accounting and tax service provider in Fort Lauderdale, FL, to ensure that everything is maintained in the perfect manner. Our team believes in complete honesty and integrity in their services so that each of the business owners Legal E-Billing of Fort Lauderdale is one hundred percent satisfied. We offer upfront pricing and clear deadlines, which we strictly adhere to and protect your business from paying any penalities. The ideal candidate for this role should possess a foundational understanding of accounting principles and practices and familiarity with QBO or Xero accounting software.

We are committed to your success.

- Sign up as a customer today and get a free month of bookkeeping.

- It’s incredibly rewarding to see the impact that good bookkeeping can have on a business.

- With Bench, you get a team of real, expert bookkeepers in addition to software.

- We’ll work with you to connect accounts and pull the financial data we need to reconcile your books.

- Our goal is to bring relief to your financial stress, fuel your growth, and add value to your business.

This feature saves you the time and effort of manually uploading documents. We are always available to spend time with you so you fully understand how to interpret and utilize the financial information we provide. Please feel free to call us whenever you have a question or concern. Use the bookkeeping services fort lauderdale convenient Xendoo app and online portal to access your financial data and reports anytime.

- Shortly after you sign up, we’ll give you a call to learn more about your business and bookkeeping needs.

- Get caught up and keep your books with Xendoo’s U.S.-based experts.

- Our bookkeepers reconcile your accounts, categorize your transactions, and make necessary adjustments to your books.

- We offer free consultations to discuss your questions and understand the scope of your needs.

- Our commitment to providing top-tier tax, bookkeeping, and financial services sets us apart in the industry.

We help your business grow.

Our bookkeepers reconcile your accounts, categorize your transactions, and make necessary adjustments to your books. The petty cash end result is a set of accurate financial statements—an income statement and a balance sheet. Life’s a beach in Fort Lauderdale—especially for small business owners who spend as little time as possible keeping their books.

- Published in Bookkeeping

Notes Receivable in Accounting

When a note receivable is considered impaired, the company must recognize an impairment loss, which reflects a decline in the anticipated cash flows from the note. Impairment may occur due to a variety of factors, such as the borrower’s deteriorating financial condition, which casts doubt on their ability to make payments. notes receivable in balance sheet The assessment of impairment is a judgment call that requires significant estimation and consideration of current economic conditions.

Example of Notes Receivable Accounting

It is not unusual for a company to have both a Notes Receivable and a Notes Payable account on their statement of financial position. Notes Payable is a liability as it records Bookkeeping for Chiropractors the value a business owes in promissory notes. Notes Receivable are an asset as they record the value that a business is owed in promissory notes.

- For instance, if a sale is net 10, you have 10 days from the time of the invoice to pay your balance.

- The note’s principal amount is the amount the debtor promises to pay back.

- This difference would be deemed as additional compensation and recorded as Compensation expense.

- Impairment may occur due to a variety of factors, such as the borrower’s deteriorating financial condition, which casts doubt on their ability to make payments.

Do you own a business?

All of our content is based on objective analysis, and the opinions are our own. The Bullock Company’s journal entries for 1 November 2019, 31 December 2019, and 31 income summary January 2020 are shown below. In this example, interest is based on the fact that the note has been outstanding for 62 days.

- The remaining principal of the note reflects the amount yet to be collected, and the note’s term, such as 10, signifies the duration until repayment.

- A written promissory note gives the holder, or bearer, the right to receive the amount outlined in the legal agreement.

- When the stated rate is not the same as the market rate, or the note is non-interest bearing, the note is recorded at either a premium or a discount.

- Taxfyle connects you to a licensed CPA or EA who can take time-consuming bookkeeping work off your hands.

- A closely related topic is that of accounts receivable vs. accounts payable.

Accounts Receivable on the Balance Sheet

The total discount $480 amortized in the schedule is equal to the difference between the face value of the note of $10,000 and the present value of the note principal and interest of $9,250. The amortized discount is added to the note’s carrying value each year, thereby increasing its carrying amount until it reaches its maturity value of $10,000. As a result, the carrying amount at the end of each period is always equal to the present value of the note’s remaining cash flows discounted at the 12% market rate.

- Notes receivable can arise due to loans, advances to employees, or from higher-risk customers who need to extend the payment period of an outstanding account receivable.

- The ability to raise cash in this way is important to small and medium-sized businesses, which may have limited access to finance.

- The placement of notes receivable on the balance sheet provides insight into the timing of future cash inflows, which is valuable information for investors and creditors.

- Square has recently gotten into lending money to its customers through its Square Capital program.

- Note that the interest component decreases for each of the scenarios even though the total cash repaid is $5,000 in each case.

- Many business calculators require the use of a +/- sign for one value and no sign (or a positive value) for the other to calculate imputed interest rates correctly.

Let’s say a company lends $10,000 to a customer on January 1, 2023, and the customer signs a promissory note agreeing to repay the loan plus interest at a predetermined rate of 8% per year. The terms of the note specify that the loan must be repaid in full within one year. A note payable is the counterpart to a note receivable, with the maker of the note being the debtor who is obligated to pay the note. The principal balance of the note receivable is the principal of the note reported on the balance sheet date. A note receivable of $300,000, due in the next 3 months, with payments of $100,000 at the end of each month, and an interest rate of 10%, is recorded for Company A.

- Published in Bookkeeping

QuickBooks Online Pricing And Plans 2024 Guide

Many accounting professionals also offer set-up services, ongoing support, and advisory services to help your small business work successfully on QuickBooks. To use many features of QuickBooks Online on your mobile device, sign in from your web browser and download the QuickBooks app. Multiple users can be signed in at the same time without any complicated network setup or expensive hosting service. QuickBooks Online Plus is not a good fit for businesses with more than 250 active accounts, more than 40 classes and locations, and the need to manage more than five users.

Talk to sales

The bank reconciliation module must also let users reconcile accounts with or without bank feeds for optimal ease of use. Most small businesses will find Plus the perfect fit, but there are many reasons you may want to upgrade to Advanced, especially now that several new features have been added. It now offers fixed asset accounting, estimated vs actual cost reporting, and multi-company report consolidation. These can be useful for companies with more complex business structures and accounting workflows. With QuickBooks Essentials, you can track billable time by job and assign it to a specific customer—something you can’t achieve with Simple Start.

Let us teach you QuickBooks Online with a free 1-hour personalized setup call*

Our expert industry analysis and practical solutions help you make better buying decisions and get more from technology. Once you’ve created an account, you go through a brief setup to tell QuickBooks Online some basic information about your business. The what does vertical analysis of a balance sheet tell about a company app works in the background to change some of the core settings to accommodate your specific type of business.

- QuickBooks Online also offers more automation features, which might be a better fit for small businesses — the more tasks you can delegate to the software, the more efficient your business will be.

- Meanwhile, Essentials gives you access to more than 40 reports, including those you can generate in Simple Start.

- As a Priority Circle member, you get access to a dedicated customer success manager who can assist you with any questions or issues you have with your software.

- QuickBooks Money is a financial management tool for one-person businesses who need an all-in-one payments and banking solution.

- It’s free to open, with no monthly fees or minimum balance requirements, giving solopreneurs and freelancers control of their money from anywhere.

With Plus, you can create projects and add income, expenses, and wages. The Projects tool helps you manage different jobs and projects for your clients and track costs related to labor and materials. POs are essential because they help you specify what products and services you need from your vendor or supplier and by when you need them. When creating POs in Plus, you can input specific items you want to purchase.

QuickBooks Online plans are incredibly scalable, so you can start small times interest earned ratio explained and upgrade to a larger plan in the future. Make sure you are on the right QuickBooks plan, so you aren’t paying for features you don’t need. For example, if you bought the QuickBooks Plus plan because you thought you’d be using the Project Management feature and you haven’t used it in over a year, consider downgrading to the Essentials plan.

Using QuickBooks Online as a Service-Based Business

The dashboard and correlation analysis transaction management are great, and you can track mileage automatically as you drive. Transaction forms like invoices and expenses are identical to or nearly as detailed as they are on the desktop. The mobile apps are attractive and easy to navigate, giving you a better user experience than even the browser-based version. The site offers a full complement of sales transaction forms, from invoices and estimates to sales receipts and credit memos. Invoice forms are more customizable in both design and content than what you get from other small business accounting software, and you can include custom fields.

For more information about services provided by Live Bookkeeping, refer to the QuickBooks Terms of Service. If you don’t need accounting just yet, our new money solution offers banking, payments, and 5.00% APY—all with no subscription or starting fees. All plans (except QuickBooks Simple Start) come with an unlimited number of time-tracking-only users. If you have five employees who need to track time and only two who need access to other features in the software, you can still use the Essentials plan without upgrading to the Plus plan. FreshBooks’ pricing starts at $17 per month, so it costs a little less than QuickBooks’ $20-per-month plan.

QuickBooks Advanced is best for enterprise businesses with support for extra users and new features which help businesses operate more efficiently at scale. You can also create a supplier database and generate purchase orders to help manage your accounts payable. It’s worth noting, however, that these prices are part of a special deal that gets you 50% off for the first three months. After that, the Simple Start tier goes back to the standard price, which is $35 per month, while the Advanced plan goes as high as $235 per month. On top of that, you’ll have to forego the 30-day free trial to get access to these lower prices. You can switch plans or cancel at any time, allowing you to adjust to fit new business needs as you grow.

- Published in Bookkeeping

Accounts Payable vs Accounts Receivable: Understanding the Differences

When you purchase goods and services on credit, you record the transaction as a liability on your balance sheet. Corporate financial management acts as the pillar on which a successful organization stands. Include accounts payable and accounts receivable; all areas of finance are essential for any company’s smooth and financially sound operation. These two critical components perform separate but joint functions that draw cash flow into the company. Just like accounts receivables, it is important for businesses to effectively manage their accounts payables. For if left unpaid for a long time, these have the potential to severely damage a business’ relationship with its lenders or suppliers.

Apple Pay vs. Google Pay at Online Casinos: A Detailed Comparison

Airwallex’s editorial team is a global collective of business finance and fintech writers based in Australia, Asia, North America, and Europe. Offering familiar and intuitive payment experiences, automating invoicing and reminders, and conducting thorough credit checks can help mitigate the challenges of AR management. Prioritising AR management strengthens your financial foundation, reduces risk, and creates new growth opportunities. AR also gives you visibility over short-term assets, allowing you to acquire stock or infrastructure with minimal risk. These liquid assets are critical for maintaining operational flexibility and seizing growth opportunities.

For business owners, a working knowledge of both accounts payable and accounts receivable is necessary to sustain business operations. Accounts payable is money your company owes to vendors and suppliers—and are often referred to as liabilities. Some examples include expenses for products, travel expenses, raw materials and transportation. If the company is satisfied with the products and services, it’ll send an invoice within the agreed-upon payment period (e.g., net-30 or net-90).

The AR process involves managing money owed to a company by its customers, including invoicing and payment collection. The AP process involves managing money a company owes to its suppliers, including receiving invoices, verifying them, and making payments. By embracing automation in your AP and AR processes, you can streamline your finance operations, reduce errors, improve efficiency, and gain better visibility into your cash flow.

What Is an Invoice? Accounting 101 Best Practices

Invoices collect payment after a company delivers goods or services to its customers. While internal practices may vary for accounts payable and accounts receivable, every accounts payable department must use a double entry, accrual-based accounting that follows a version of GAAP. Accounts payable and accounts receivable are opposite but interconnected procedures. Together, they comprise the very basics of business and can be used to gauge financial health. Accounts payable and accounts receivable are key to understanding the financial standing of your business.

When a customer makes partial payments, businesses need to update the AR balance to reflect the actual amount paid. Accounts receivable is money owed to a business by customers, while accounts payable is money a business owes to its suppliers or creditors. With end-to-end financial capabilities – including payment acceptance, multi-currency wallets, spend management, and FX and transfers – Airwallex simplifies every step of your AR process. Instead of chasing invoices, you can spend more time growing your business, building customer relationships, and seizing new opportunities, all while your AR operations run smoothly in the background. Track payment trends, identify potential bottlenecks, and highlight areas for improvement.

Understanding Accounts Receivable vs Payable for Financial Management

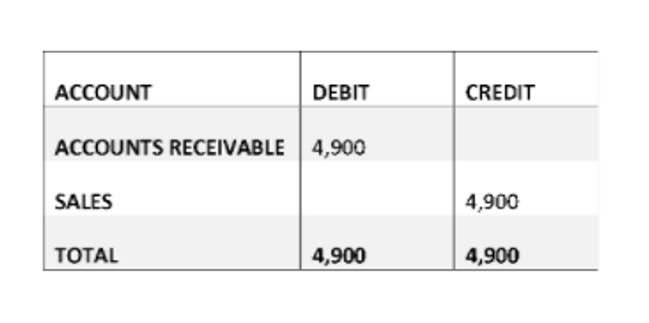

Moving AP processes to an external provider doesn’t happen overnight, and you’ll need to budget the time and capital for a transition period. In addition to training staff on new policies and procedures, you’ll want to account for extra time for integrating systems and adapting to new workflows. Employees used to in-house processes may also struggle with new approval structures and dependencies with an external team. Think of accrued expenses as recognizing you owe money before the official bill comes, and Accounts Payable as what you record after you get the official bill. Accrued expenses are estimations, while Accounts Payable are based on concrete invoices. This entry ensures the sale is recorded properly and shows the amount expected to be paid in the future.

Below, you’ll find a breakdown of some key differences between the two platforms. With its excellent expense management and billing features, Xero can handle the needs of businesses with high turnovers, who may find Freshbooks a little limiting. Additionally, Xero boasts a massive library of available third-party integrations, which means you can add new capabilities whenever you see fit. If your business’s transaction volume changes, an AP outsourcing company can scale up or down without the need for additional hiring or complex restructuring. This can be a major plus for small businesses looking forward to a growth spurt. Outsourcing can reduce processing costs by eliminating the need for an in-house AP staff.

Accounting software can save you time by doing some of the more tedious work involved in accounts payable and accounts receivable for you. The ideal accounting software product will depend on the type of business you run, but most programs can be customized to fit your specific needs. Accounts receivable is the money your business brings in, while accounts payable is the money your business owes its suppliers and vendors.

Accounts receivable supports effective compliance and reporting

- Efficient AP also lets you focus on other areas of finance, like tax management and budgeting.

- The discounts benefit both parties because the borrower receives their discount while the company receives their cash repayment sooner, as companies require cash for their operating activities.

- An accounts payable outsourcing company that handles global payments can provide local compliance expertise and manage currency conversions to achieve favorable rates.

- Accounts payable and accounts receivable are both critical finance functions within a company.

Our software makes it possible to digitize receivables, automate processing, reduce time-to-cash, eliminate transaction fees, and enable new revenue. The company records the sale as a debit to accounts receivable and a credit to sales revenue. For example, a company purchases $10,000 worth of inventory from a supplier on credit.

A job in accounts payable can be stressful if a business relies on manual processes. A company that keeps track of accounts payable will be able to determine where its money is going and how to be more cost-efficient. Meanwhile, a business that monitors its accounts receivable will be able to be up to date on its profitability and follow up on invoices past the due date. You should also utilize accounting software or bookkeeping software to oversee the liabilities and assets related to your business. Yes, you can automate accounts payable using AP automation tools and software that handle invoice processing, approvals, and payments on behalf of your team. Systems like QuickBooks and NetSuite integrate with existing accounting systems for seamless data transfer.

- Some examples include expenses for products, travel expenses, raw materials and transportation.

- If you have provided a good or service that hasn’t yet been paid for, that item is recorded as a current asset.

- When accounts payable and accounts receivable are managed seamlessly, businesses can focus on growth and long-term success.

- Similar to the above example, debiting the cash account by $250,000 also means an increase in cash account by the same amount.

- Since it reflects an amount that the company owes, it’s considered a debt or obligation rather than a resource.

Accounts Payable vs. Accounts Receivable: Key Differences

When your company receives this invoice, they will now record an Accounts Payable of ₹50,000. The accrued expense previously recorded for March will be adjusted or removed because the exact amount is now known from the invoice. Accounts Payable is created because your company has received a formal invoice account payable vs accounts receivable from the vendor company for services already provided, and it’s now a short-term debt with payment terms on the invoice. By the end of this guide, you will have a clear understanding of accounts payable versus accrued expenses and their role in financial management.

Send an invoice to accounts receivable if you are requesting payment for goods or services provided. If you receive an invoice from a supplier or vendor, it goes to accounts payable because you owe money for goods or services received. Accounts receivable handles incoming payments, while accounts payable manages outgoing payments.

The accounting department closely monitors these receivables to ensure timely payments and maintain a healthy cash flow. Accounts Receivable (AR) represents the outstanding amount owed to your business for goods or services delivered to customers on credit. The payment time for such accounts ranges from a few days to an entire calendar year.

- Published in Bookkeeping

Debit memo definition: What is a debit memorandum? Acrobat Sign

The memos typically are shown on bank customers’ monthly bank statements; the debit memorandum is noted by a negative sign next to the charge. A business issues a debit memo to its customers to acknowledge additional charges, underpayments, http://novichok1c.ru/vopros/rabota-s-excel-iz-1s and billing corrections that benefit the business. While debit notes are traditionally used to inform customers of additional charges or adjustments to invoices, they can also serve as reminders for outstanding payments.

- This will result in accurate financial records, streamlined financial transactions, and improved trust among businesses and customers.

- While debit notes are traditionally used to inform customers of additional charges or adjustments to invoices, they can also serve as reminders for outstanding payments.

- Therefore, the extra compensation is required to be charged, increasing the business’s revenue.

- After understanding the essential components of a debit memo, let’s see when businesses use them.

- If you incur a fee through your bank, like for printing checks or an overdraft, the bank will debit your account directly to cover that fee.

- A debit memo is a document issued by a seller to inform the buyer or customer that their account has been debited or increased by a specific amount due to additional charges.

Credit Memo vs Debit Memo Explained

We recommend that you review the privacy policy of the site you are entering. SoFi does not guarantee or endorse the products, information or recommendations provided in any third party website. ABC Ltd have now correctly billed XYZ Ltd, and XYZ Ltd have the correct amount owed on their records too. Have a look at the key differences between them for accurate financial record-keeping and effective communication with customers. Choose InvoiceOwl to manage your invoices efficiently and get paid on time without any hassle. Our goal at MapleMoney is to present readers with reliable financial advice and product choices that will help you achieve your financial goals.

Invoice discrepancies

When the credit balance seems to be large, an organization is more likely to refund the customer instead of issuing a debit memo. This approach is more customer-centric and helps maintain a positive relationship. Qualifying accounts can even access their paycheck up to two days early. Even if you have no money in your account, you can go into a negative balance.

What Is a Credit Memo?

Such situations can complicate the handling of invoices, subsequently impacting the order-to-cash process. Fortunately, businesses have tools to alleviate these challenges – debit memo vs credit memo. Let’s explore http://sciencecluster.ru/BCom/BComShow.asp?ID=82280 these options and understand how they are similar and different. If you accidentally submit an invoice that’s too low, you can send a debit memo to correct it and increase the invoice after it’s sent.

- It can streamline operations, reduce unforeseen errors, and simplify the creation of debit and credit memos.

- The good news is we put together this guide to cover the most important pieces of information.

- In this case, the fees act as an adjustment rather than a specific bank transaction.

- Here are some primary reasons that prompt businesses to issue debit memos for adjusting financial accounts.

- Global Distribution Systems (GDS) are well known for NOT being intuitive or user-friendly.

Resources for Your Growing Business

This helps to indicate when adjustments get made and it will end up increasing the total amount due. Credit memos effectively reduce a business’s accounts receivable by documenting adjustments, thus decreasing outstanding balances owed by customers. http://www.bar22.ru/company/c_2719.html One of the common reasons behind issuing a credit memo is to rectify errors in the invoices. For example, there are errors in the original invoice, such as overcharging the customer, applying incorrect prices, or billing for items not received.

Debit Memo vs Credit Memo: How Are They Different?

Elements to Include in a Debit Memo

- Published in Bookkeeping

8 Best Finance and Accounting Outsourcing Companies in 2024

They’re not tied to TeamUp, meaning the staff you hire won’t be reassigned to other accounts, and you retain full control and oversight of your entire team — both on and offshore. Visit our news page to stay up to date on leadership appointments, partnerships and otherindustry developments. Practical solutions to the issues you face, along with emerging industry topics forward-looking practitioners are curious about. As a leading think tank, the Thomson Reuters Institute has a proud history of igniting conversation and debate among the tax and accounting.. Ask anyone who has launched a small business and they will remember how exciting the early days were. You know, those times of the year when coffee becomes your best friend and the office practically turns..

Customizing Outsourcing Solutions for Growth

Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed here. Get the guidance and technology you need to manage your sales tax obligations and grow with confidence. Nevertheless, these data are truly useful to management and investors of the company in case of their relevance, objectivity and completeness of the indicators reflect business activity. It’s likely that an outsourced CFO has experienced these challenges before, making them well-qualified to advise your business on its strategic direction.

Why Do Businesses Use Outsourced Accounting Services?

We have the automated solutions to help simplify claiming research & design tax credits, calculate your monthly recurring revenue and run rate. Aprio can fully automate and outsource your payroll and HR functions, help with benefits, training and other important tools to retain and grow your workforce. View industry-leading technologies vetted & tested by Aprio for accounting, bill-pay, payroll, reporting, ecommerce and more. Give your team the freedom to focus on delivering strategic growth for your firm rather than drowning in non-essential busy work. Outsmart your competitors by adding highly skilled accounting professionals to your firm faster. These tasks are more strategic in nature than the work typically performed by bookkeepers.

A provider that combines technical expertise with a strong client relationship focus is likely to be a valuable partner in driving your business’s financial success. Paro has emerged as a dynamic force in the finance and accounting outsourcing sector, known for its highly personalized and flexible service offerings. They specialize in connecting businesses with a curated network of top-tier financial professionals, ranging from CPAs to financial analysts. Paro’s strength lies in its rigorous vetting process, ensuring that each professional in their network is not only skilled but also perfectly matched to the unique needs of their clients. This bespoke approach allows Paro to provide tailored solutions that cover a wide spectrum of financial services, from day-to-day accounting tasks to high-level financial strategies and analyses.

Outsourcing enables companies to optimize their financial analysis process by focusing on key performance indicators such as profitability, efficiency, and liquidity. Additionally, external partners can provide regular financial health checks, ensuring that potential issues are identified and addressed proactively, leading to a more stable and profitable business. Aprio couples automated technology solutions with knowledgeable advisors to manage your accounting, payroll, sales tax & more – all from the cloud. Permanently enterprise increase your firm’s capacity with a dedicated outsourced accounting team in weeks, not months. Profit from the knowledge and experiences of industry experts and firms that have grown with globaltalent solutions.

Bookkeeping Onboarding Checklist: Sprinting Towards a Smooth Client Handoff

- Their goal is to help firms fill talent gaps and support growth without hiring full-time staff.

- Since 2005, Maxim Liberty has offered flexible and affordable outsourced bookkeeping services for CPA firms in Canada and the United States.

- This is not a complete list of benefits that businesses can expect when partnering with an outsourced accounting firm.

- Outsourcing finance and accounting functions can have a significant positive impact on a company’s efficiency.

- When collaborating with an outsourced accounting service provider, businesses gain access to a team of skilled accounting professionals.

Their bookkeepers are trained in several accounting software programs and can update client books as frequently as you desire, whether daily, weekly, or monthly. Outsourcing your bookkeeping to an accounting firm ensures that your business’s financial data is organized according to best practices. Outsourced accounting firms tend to use cloud-based bookkeeping technologies that provide business owners with a real-time overview of their business’s financial position.

With an outsourced partner managing these critical tasks, companies can prioritize their core competencies and devote more time and resources to expanding their business and reaching new heights. One of the critical aspects of outsourcing accounting is its scalability and flexibility. Outsourcing enables organizations to adapt to the changing requirements of their finance and accounting functions. As a company grows, its financial processes and needs expand, necessitating a more advanced system in place.

But in reality, many businesses across the country, big and small, are embracing outsourced accounting. Among all these day-to-day activities, it can be difficult to find time for your accounting, even though you know how important it is to your business. Maintaining accurate, timely financial information is vital in enabling you to make better decisions for your business. But for many businesses, the process of arriving at that point of financial clarity is lined with challenges.

Typical Accounting Services That Can Be Outsourced

Plans start at $50 per month with the Monthly Updates plan for 5 hours of support each month and range up to $200 per month with the Daily Updates plan, which includes 20 hours of support a month. The Back Room has a one-time setup fee to get started, which covers recruitment, onboarding, and equipment costs. The ongoing monthly fee covers employee salaries, benefits, allowances, and their fee. The Back Room is a skilled team of offshore accountants and business support specialists who make it easy to expand your capacity without going through the expensive recruiting, onboarding, and training process. All of their accountants and CPAs have bachelor’s or master’s degrees and receive regular training to expand their capabilities and offer quality service to their clients. By outsourcing these tasks, companies can focus on their core competencies, streamline their operations, and create a more transparent financial environment.

- Published in Bookkeeping

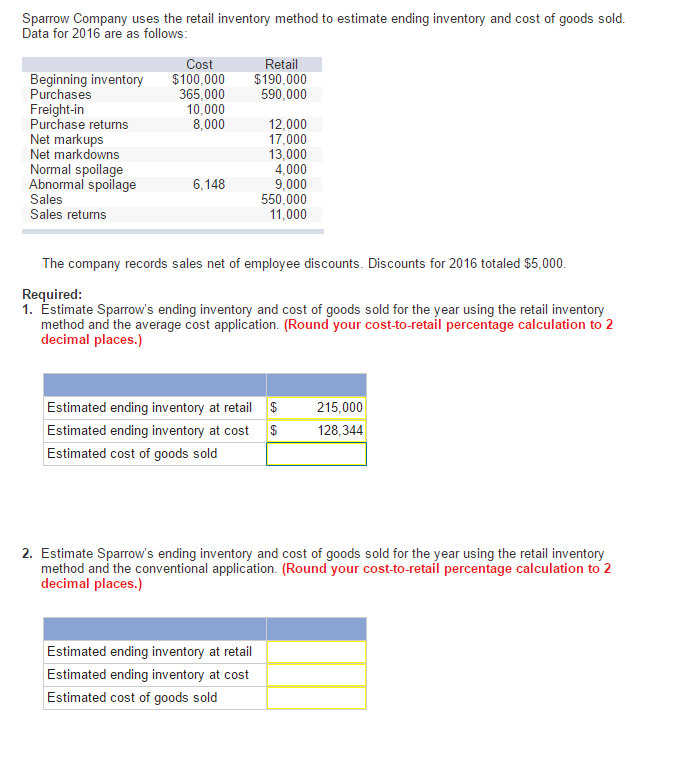

Average Cost Method: Definition and Formula With Example

This simplicity can be especially valuable for businesses with extensive inventories that would otherwise require complex tracking of individual item costs. By using the average cost, the administrative burden is lessened, freeing up resources to focus on other areas of the business, such as sales, customer service, or product development. It is particularly beneficial for companies that face volatile purchase prices, as it mitigates the impact of cost variances and provides a stable view of inventory valuation over time. The average cost method is a key approach in inventory valuation, affecting how businesses report their financial health. This method distributes the total cost of goods available for sale evenly across all units, providing a straightforward way to assess inventory value.

Understanding the Average Costing Method

FIFO assumes the oldest inventory items are sold first, often aligning with the actual physical flow of goods. This method usually results in lower COGS during periods of rising prices, inflating profits and increasing tax liabilities in the short term. LIFO assumes the most recently acquired inventory is sold first, which can be advantageous in a high inflation environment by reducing taxable income through higher COGS. However, LIFO can lead to outdated inventory values on the balance sheet.

How Will You Determine Your Average Inventory Cost?

If you want to learn more about it, read our QuickBooks Online review for a comprehensive analysis. For example, on day 3, we add the units and total cost of the new purchase (100 units and $1020) to the opening balance (25 units and $250). We then divide the new total cost of $1270 ($1020 + $250) by the new total units of 125 (100 + 25) to calculate the new average cost of $10.16 ($1270 ÷ 125). In this lesson, I explain the easiest way to calculate the ending stock value using the average cost method under both periodic and perpetual inventory systems. Average cost method assigns a cost to inventory items based on the total cost of goods purchased or produced in a period divided by the total number of items purchased or produced. This ensures that the company has the right number of items in stock at the right time, improving inventory turnover and optimizing operations.

- Now you have an idea of how to navigate the average cost method, but what are the benefits involved?

- It smooths out the price effects seen in FIFO and LIFO, offering a moderate impact on both COGS and ending inventory valuation.

- It calculates the cost of inventory items by averaging the total cost of goods available for sale over a specific period and dividing it by the total number of units available for sale.

- This is why good accounting software is ideal to use the perpetual system because maintaining perpetual records manually requires a lot of work.

- The COGS figure is then subtracted from sales revenue to determine the company’s gross margin.

Intrinsic Value vs. Current Market Value: What’s the Difference?

Using the average inventory method the total cost of goods available for sale is averaged and any two units are sold at the average cost. The COGS and Inventory calculations in the perpetual system are the same as in the periodic system, except you need to adjust the average unit cost in real time for each purchase and sale. This is why good accounting software is ideal to use the perpetual system because maintaining perpetual records manually requires a lot of work.

The average cost calculation formula is as follows:

Finally, standard costing will provide a focus on cost control and overall planning for any organization, and usage is heavily concentrated on large manufacturing organizations. All four of the listed methodologies offer distinct benefits, making it important for management to assess which option aligns best with the strategic direction of their company. The Average Costing Method is a valuable tool for businesses seeking a simple and consistent approach to inventory valuation. Averaging costs provides a stable basis for financial reporting and helps manage price fluctuations.

Comparing ACM with Other Inventory Valuation Methods

The last in first out method involves the cost of the previous item purchased becomes the price for the first item to be sold. The cost of the last item you are buying should be the cost of the first item you sell. This culminates in the closure of inventory reported on the balance irs moving expense deductions sheet as the cost of the earliest item that you purchased. In an inflammatory environment, the LIFO method results in ending inventory that is less than the prevailing cost. It means you are selling products to your customers, and as such, you must deal with an inventory.

Each time, purchase costs are added to beginning inventory cost to get cost of current inventory. Similarly, the number of units bought is added to beginning inventory to get current goods available for sale. After each purchase, cost of current inventory is divided by current goods available for sale to get current cost per unit on goods. The use of average costing method in perpetual inventory system is not common among companies. These footnotes are not released when financial statements are only being issued internally, since the management team is already aware of the costing method being used. Please be aware that after you choose your inventory costing method, you should always follow this method in the course of your business.

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Each method has its own set of advantages and disadvantages, and the choice depends on the business’s specific needs and inventory characteristics.

For illustration purposes, let’s keep our moving average unit cost at $73.13. But if we compute for COGS, let’s extend to five decimal places to minimize rounding differences. When we record a sale, we use the new average unit cost to compute the COGS. In our ledger below, we multiplied 250 units by the new average unit cost of $30. In our books, we record the purchases directly to Merchandise Inventory since we’re using the perpetual inventory system.

You’ll see that the actual price at this time is $170 and yet the average cost is only $90. We still have to pay $170 per unit to suppliers even though our costing is at $90. When market prices rise, the average cost is lower than the actual price. This difference has several implications—lower average cost would mean lower cost of goods sold, higher net income, and higher income taxes. However, a low average cost would not affect the amount that we’ll pay to suppliers. Dividing the total cost with the 25 units of inventory available on that day (5 + 20), the average cost of 1 unit should equal $37.

- Published in Bookkeeping

Reconciling Account Overview, Process, How It Works

In doing so, the business can effectively manage cash flow, ensuring timely payment of bills, and collection of receivables. It involves reviewing the general ledger to confirm that all entries and balances are correct. On the other hand, general ledger reconciliation focuses on the internal review of accounts. This is critical because any discrepancies left unaddressed could distort a company’s understanding of its financial health.

- The objective of doing reconciliations to make sure that the internal cash register agrees with the bank statement.

- A common example of account reconciliation is comparing the general ledger to sub-ledgers, such as accounts payable or accounts receivable.

- Account reconciliation aids in financial reconciliation, ensuring that the numbers reported on the financial statements reflect the company’s true financial position.

- Ideally, it should be someone who is not involved in the day-to-day transactions that performs it to maintain objectivity and ensure a thorough review.

- By comparing these two sets of records, the business can identify discrepancies and adjust its internal records accordingly.

- This document summarizes banking and business activity, reconciling an entity’s bank account with its financial records.

For further confirmations and checks on how you can implement AI, don’t hesitate to sign up for a free consultation with our AI experts. A profit and loss statement displays revenue earned for depreciable asset definition that period, then subtracts the cost of goods sold, interest expense, and other operating expenses from the revenue to determine net income for the period. Upgrading to a paid membership gives you access to our extensive collection of plug-and-play Templates designed to power your performance—as well as CFI’s full course catalog and accredited Certification Programs.

Because the individual is fastidious about keeping receipts, they call the credit card to dispute the amounts. After an investigation, the credit card is found to have been compromised by a criminal who was able to obtain the company’s information and charge the individual’s credit card. The individual is reimbursed for the incorrect charges, the card is canceled, and the fraudulent activity stopped. At the end of the month, the account holder checks the transactions on the credit card bill with their credit card receipts and discovers that they have no receipts for some of the supposed lunch charges that appear on the bill.

Account reconciliation is a critical financial process that ensures the accuracy and consistency of an organization’s financial records. By comparing internal financial statements with external sources, such as bank statements, businesses can identify discrepancies, correct errors, and maintain financial integrity. In accounting, reconciliation refers to the practice of comparing two sets of financial records to make sure they are accurate and free from errors. The process typically involves comparing accounts in the company’s general ledger and sub-ledgers with external financial documents like invoices, receipts, and bank statements. Account reconciliation is the process of cross-checking a company’s financial records, like the general ledger (GL) and sub-ledgers (SL), with external documents, such as bank statements. Its purpose is to ensure accuracy and consistency of financial data, which is vital for informed decision-making and maintaining financial integrity.

Sign up for latest finance stories

Tick all transactions recorded in the cash book against similar transactions appearing in the bank statement. Make a list of all transactions in the bank statement that are not supported, i.e., are not supported by any evidence, such as a payment receipt. It’s also important to ensure you maintain detailed records of the three-way reconciliation accounting process.

Reconciliation in accounting best practices

The correction will appear in the future bank statement, but an adjustment is required in the current period’s bank reconciliation to reconcile the discrepancy. Reconciling an account is an accounting process that is used to ensure that the transactions in a company’s financial records are consistent with independent third party reports. Reconciliation confirms that the recorded sum leaving an account corresponds to the amount that’s been spent and that the two accounts are balanced at the end of the reporting period. Take note that you may need to keep an eye out for transactions that may not match immediately between the sets of records for which you may need qualitative characteristics of accounting information overview guide to make adjustments due to timing differences.

Types of Account Reconciliations

Even if you are using software that automatically downloads your monthly bank transactions, it’s still important to reconcile your accounts. By comparing these two sets of records, the business can identify discrepancies and adjust its internal records accordingly. This procedure ensures that the business’s internal records align with external data.

Reconciliation ensures that accounting records are accurate, by detecting bookkeeping errors and fraudulent transactions. The differences may sometimes be acceptable due to the timing of payments and deposits, but any unexplained differences may point to potential theft or misuse of funds. The company should ensure that any money coming into the company is recorded in both the cash register and bank statement.

What is a three-way trust reconciliation?

For lawyers, this process helps to ensure accuracy, consistency, transparency, and compliance. The purpose of reconciliation is to ensure the accuracy and ethics of a business’s financial records by comparing internal accounting records with external sources, such as bank records. This process helps detect errors, prevent fraud, ensure regulatory compliance, and provide reliable financial information for data-driven decision-making. Account reconciliation is necessary for asset, liability, and equity accounts since their balances are carried forward every year. During reconciliation, you should compare the transactions recorded in an internal record-keeping account against an external monthly statement from sources such as banks and credit card companies.

Some of the possible charges include ATM transaction charges, check-printing fees, overdrafts, bank interest, etc. The charges have already been majority shareholder: everything you need to know recorded by the bank, but the company does not know about them until the bank statement has been received. It is possible to have certain transactions that have been recorded as paid in the internal cash register but that do not appear as paid in the bank statement. An example of such a transaction is a check that has been issued but has yet to be cleared by the bank. Nearly a third of the businesses are gearing up to digitally transform their accounting operations using a slew of technologies, including cloud, AI, analytics, and RPA.

- Published in Bookkeeping

What Are Accruals? How Accrual Accounting Works, With Examples

It may present either a gain or loss in each financial period in which the project is still active. The electricity company needs to wait until the end of the month to receive its revenues, despite the in-month expenses it has incurred. Meanwhile, the electricity company must acknowledge that it expects future income. Accrual accounting gives the company a means of tracking its financial position more accurately.

Benefits of Using the Accrual Method

It is usually done by creating a journal of all the transactions in the accounting system. An example of an accrual would be for some work completed but not invoiced yet. Whereas accrual accounting’s strengths lie in accurately showing business profitability and representing long-term revenues and expenses, it has a few drawbacks as well. Non-profits benefit significantly from accrual accounting in managing grants and donations.

Service-Based Businesses

A member of the CPA Association of BC, she also holds a Master’s Degree in Business Administration from Simon Fraser University. In her spare time, Kristen enjoys camping, hiking, and road tripping with her husband and two children. The firm offers bookkeeping and accounting services for business and personal needs, as well as ERP consulting and audit assistance. The IRS 12-month rule states that taxpayers do not have to capitalize amounts paid that will benefit them within a 12-month period.

As a result, it has become the standard accounting practice for most companies except for very small businesses and individuals. Accrual accounting is not simple and requires thorough record keeping, with close attention to detail. Depending on the size and complexity of your company, you may need to hire a professional accountant.

How accrual accounting works for different adjusting entries

- This makes the selection of the right accounting method extremely important.

- HighRadius R2R solution provides a transformative approach to optimizing accounting processes, ensuring organizations stay ahead in the dynamic landscape of financial management.

- The accrual method complies with generally accepted accounting practices (GAAP) because it recognizes costs and expenses when they happen, not when the money changes hands, and utilizes double-entry accounting.

- Revenue and expenses are only recorded when cash is exchanged under cash accounting.

- Expenses are recorded when they’re incurred regardless of when they’re paid.

The sale is recorded as revenue at the time of the transaction, even though the cash payment might be received at a later date. Accrual accounting provides a more accurate picture of a company’s financial position. However, many small businesses use cash accounting because it is less confusing. The general concept of accrual accounting is that accounting journal entries are made when a good or service is provided rather than when payment is made or received. Accruals and deferrals are the basis of the accrual method of accounting, the preferred method by generally accepted accounting principles (GAAP). An accountant makes adjustments for revenue that’s been earned but not liabilities meaning in accounting yet recorded in the general ledger and expenses that have been incurred but are also not yet recorded.

These are then expensed systematically over the period to which they pertain, reflecting the consumption of the service or benefit over time. The received capital can then be moved to other accounts, such as free cash, if needed—the company uses the same double-entry method to enter which account the capital came from and is moved to. From data fetching to journal entry and analysis, HighRadius empowers organizations to achieve a groundbreaking 50% reduction in manual tasks through its no-code platform, LiveCube. Accountants can effortlessly retrieve raw data, perform calculations, and seamlessly upload results into various enterprise systems, streamlining the entire record-keeping workflow.

Other, more complicated transactions involve buying and selling on credit, which requires a company to account for monies that they will have to pay or receive at a future date. Recognizes revenue and expenses when they are earned or incurred, irrespective of whether an actual cash transaction has occurred. With FreshBooks, you can send professional invoices, calculate expenses, accept payments online, and more using industry-standard double-entry accounting. Try Freshbooks free today and see how easy it is to manage your bookkeeping and monitor your financial health from anywhere, on all your devices. It can be more difficult for bookkeepers to keep track of transactions, and it can take longer to prepare financial statements under this method.

With cash accounting, a business will track incoming and outgoing money by looking at cash-in-hand, as soon as the transaction takes place. This means a purchase will only be recorded once the invoice is paid in full, while expenses are only noted once they’ve been paid and the money leaves the bank. Cash accounting, on the other hand, records income and expenses when you receive or deliver payment for goods and services. Comparatively, under the accrual accounting method, the construction firm may realize a portion of revenue and expenses that correspond to the proportion of the role of perception in consumer behavior work completed.

- Published in Bookkeeping

Solvency Ratios: What They Are and How to Calculate Them

Investors need to look at overall investment appeal and decide whether a security is under or overvalued. Using this information, you can easily calculate the following solvency ratios. Don’t just look at one ratio from one period; most financial ratios when will i get my tax rebate if i used turbo tax online to file my tax return are able to tell more of a story when you look at the same ratio over time or look at the same ratio across similar companies. Solvency ratio levels vary by industry, so it is important to understand what constitutes a good ratio for the company before drawing conclusions from the ratio calculations. Ratios that suggest lower solvency than the industry average could raise a flag or suggest financial problems on the horizon. This means that the company used to have $0.68 of debt for every $1 of assets.

Solvency, Liquidity, and Viability

Solvency ratios are different for different firms in different industries. For instance, food and beverage firms, as well as other consumer staples, can generally sustain higher debt loads given their profit levels are less susceptible to economic fluctuations. If companies can’t generate enough revenues to cover their current obligations, they probably won’t be able to pay off new obligations. For example, an airline company will have more debt than a technology firm just by the nature of its business.

Regarding the debt-to-assets ratio, the higher the value, the more leverage the company is using, which also means more risk for investors. Solvency is related to debt, as solvency is the measurement of how well a company will be able to pay off its debts. In other cases, it may be cheaper to take on debt rather than issue stock.

The metric is very useful to lenders, potential investors, suppliers, and any other entity that would like to do business with a particular company. It usually compares the entity’s profitability with its obligations to determine whether it is financially sound. In that regard, a higher or strong solvency ratio is preferred, as it is an indicator of financial strength. On the other hand, a low ratio exposes potential financial hurdles in the future. Solvency ratios indicate a company’s financial health in the context of its debt obligations.

If you examine it keenly, you will notice that the numerator comprises the entity’s current cash flow, while the denominator is made up of its liabilities. Thus, it is safe to conclude that the solvency ratio determines whether a company’s cash flow is adequate to pay its total liabilities. It measures this cash flow capacity versus all liabilities, rather than only short-term debt. This way, a solvency ratio assesses a company’s long-term health by evaluating its repayment ability for its long-term debt and the interest on that debt.

In other words, it measures the margin of safety a company has for paying interest on its debt during a given period. While companies should always strive to have more assets than liabilities, the margin for their what are available for sale securities surplus can change depending on their business. One of the easiest and quickest ways to check on liquidity is by subtracting short-term liabilities from short-term assets.

Before an individual or organization invests or lends money to a company, they need to be sure that the entity in question can remain solvent over time. Thus, interested stakeholders utilize solvency ratios to assess a company’s capacity to pay off its debts in the long term. Financial ratios enable us to draw meaningful comparisons regarding an organization’s long-term debt as it relates to its equity and assets. The use of ratios allows interested parties to assess the stability of the company’s capital structure.

- MetLife’s liquidity ratios are comparatively worse and at the bottom of the industry when looking at its current ratio (0.09 times).

- These include cash and cash equivalents, marketable securities, and accounts receivable.

- Credit analysts and regulators have a great interest in analyzing a firm’s solvency ratios.

- The solvency ratio measures a company’s ability to meet its long-term obligations as the formula above indicates.

- This ratio is commonly used first when building out a solvency analysis.

- The terms liquidity and solvency are often confused but actually express different concepts.

Solvency Ratios vs. Liquidity Ratios

Here are a few more ratios used to evaluate an organization’s capability to repay debts in the future. Financial firms are subject to varying state and national regulations that stipulate solvency ratios. Falling below certain thresholds could bring the wrath of regulators and untimely requests to raise capital and shore up low ratios. The debt-to-equity ratio compares the amount of outstanding debt to the amount of equity built up. This is usually worrying to investors since it indicates the company may not be able to generate enough cash to pay off the interest on the debt. When interpreting the values for solvency ratios, it’s important to consider the context.

Analyzing Investments With Solvency Ratios

While solvency is mostly used as a barometer of financial health and higher is good, it is also used to evaluate some of the operational efficiencies where higher is not always better. A solvency ratio is one of many metrics used to determine whether a company can stay solvent in the long term. Many companies have negative shareholders’ equity, which is a sign of insolvency. A high solvency ratio is an indication of stability, while a low ratio signals financial weakness. To get a clear picture of the company’s liquidity and solvency, potential investors use the metric alongside others, such as the debt-to-equity ratio, the debt-to-capital ratio, and more.

How to Calculate the Solvency Ratio

Long-term solvency typically focuses on the firm’s ability to generate future revenues to meet obligations in the future. There are also other ratios that can help to more deeply analyze a company’s solvency. The interest coverage ratio divides operating income by interest expense to show a company’s ability to pay the interest on its debt. The debt-to-assets ratio divides a company’s debt by the value of its assets to provide indications of capital structure and solvency health. Even with a diverse set of data to compare against, solvency ratios won’t tell you everything you need to know to assess a company’s solvency.

It specifically measures how many times a company can cover its interest charges on a pretax basis. Both investors and creditors use solvency ratios to measure a firm’s ability to meet their obligations. The most common solvency ratios are the debt to equity ratio, debt ratio, and equity ratio.

Book value is a historical figure that would ideally be written up (or down) to its fair market value. But using what the company reports presents a quick and readily available figure to use for measurement. As with any indicators, it’s possible for values to be misleading, particularly if they are interpreted individually.

- Published in Bookkeeping