Gross Sales Formula + Calculator

It is challenging, for example, to determine whether gross sales are high or not if you are unaware of the average gross sales of overall industry or product returns of your own business. Often times reviewing your product price helps you align with the market demand and brings you more sales. Research your competitors and adjust your product price if you need to. For example, a company selling smartphones might introduce accessories like cases, or screen protectors etc.

Gross Sales are defined as a company’s total revenue generated from all transactions that occurred over a specified period before any deductions, such as returns, discounts, and allowances. For our hypothetical scenario, we’ll assume that a 10% discount was offered to customers that paid early, which was the case in 5% of all completed customer transactions. By itself, the gross sales metric could be misleading, which is why net sales are viewed as a more useful indicator of a company’s financial performance.

Very simply, gross sales are the total amount of your sales without factoring in deductions (costs incurred to close those sales). Net sales are your gross sales minus deductions such as allowances, discounts, and returns. These are both calculated at regular interviews throughout a fiscal year, typically monthly or quarterly. Allowances are price reductions granted for issues like minor product defects or late delivery, without requiring the return of goods. For example, a $500 allowance on a $10,000 purchase adjusts net sales to $9,500. Like returns and discounts, allowances are recorded as reductions in sales revenue under GAAP.

How to Calculate Cost of Goods Sold: Formula & Examples

If a company records revenue from sales of $3 million, the company will record this as the top line sales. A well-executed pricing strategy can boost revenue, while an ineffective one can lead to missed opportunities. For instance, a premium pricing strategy positions a product as high-quality or exclusive, potentially increasing profit margins. Revenue Intelligence also offers sales insights in several forms, directly from the dashboard.

- The sum of all the receipts from sales of an entity unaffected by any adjustments is gross sales.

- The company’s COGS for the month is $60,000, representing the cost of materials used to manufacture and sell the furniture.

- Often times reviewing your product price helps you align with the market demand and brings you more sales.

- As a business owner, you should understand the difference between gross sales and net sales, as well as gross profit and net profit.

- Gross sales measures a company’s total sales without adjusting for the expenses of generating those sales.

Supercharge your sales tracking with Streak

For instance, you could’ve made a large number of sales, only to have customers return them later on. You’ll only know about this if you compare your gross and net sales together. Gross sales is best used when linked with other relevant financial metrics, such as net sales and profit margins, to provide a comprehensive view of a company’s financial health.

A practical example of calculating ROS

Another major limitation of gross sales is that the metric is really only relevant within the consumer retail industry. Companies that don’t sell goods can’t use it to evaluate their financial health at all. If your POS dashboard includes discounts and allowances, it might already calculate net sales for you, so you’ll need to figure that out on your own.

Excluded from COGS:

- You’re running a medicine subscription business that operates both a subscription service and sells products through one-off purchases.

- Set realistic sales goals for your retail business based on these numbers.

- As such, you should record all sales taxes collected as a liability rather than as sales revenue.

- A profitable mid-sized business could waste a lot of money in marketing, sending most of the money out as fast as sales come in.

Gross Revenue is the total amount of money generated by a company from its core business activities. A return authorization number — or RA — allows sellers to track a return from its outset to its end. Gross sales are an indication of how well or how poorly your sales team is performing because they show the number of total sales they’ve made.

Managing Cost of Goods Sold (COGS) manually can be time-consuming and prone to errors, especially as businesses grow. Enerpize automates COGS calculations by integrating real-time inventory tracking with purchase and sales records. It ensures accurate financial reporting by automatically updating inventory values and linking transactions, minimizing human errors and enhancing efficiency. Return on sales takes your operational profit divided by your net sales to tell you the ratio of profit to revenue. Everything from how you sell to how you produce your products is a target for improving your efficiency. But as long as you know your return on sales, you’ll be able to keep more of your company’s hard-earned sales revenue.

The store’s gross sales are the product of the ASP and the number of units sold, which amounts to $8 million in gross sales. To help you better understand how to calculate gross sales, here’s an example in action. In short, gross sales don’t reveal how efficiently your business can convert sales into profits, which is essential for analyzing operational effectiveness. Gross sales measures the total sales of a company, unadjusted for the costs related to generating those sales. But, there is a high chance that an increase in gross sales increases the level of profits of the business.

It is the number one figure that shows the full amount of income earned through sales activities over a specific period. For example, a company with $200,000 in gross sales and $20,000 in deductions reports net sales of $180,000. Net sales are prominently featured on income statements, offering stakeholders a clear view of a company’s revenue performance. Financial analysts use net sales to calculate metrics like gross profit margin, which measures how effectively a company manages production costs relative to revenue. Understanding gross sales is essential for businesses as it provides a clear picture of total revenue generation before deductions.

How to Calculate Gross Revenue?

The gross sales figure is calculated by adding all sales receipts before discounts, returns, and allowances together. That’s why the latter gives a better insight into a company’s financial position. That said, you need both numbers to calculate your company’s profit accurately.

When your net revenue is close to your gross revenue, it may suggest that customers like your product enough to keep it. It also says that you don’t have to rely on steep discounts to move products. Two of the most common how to find gross sales figures to track are gross revenue and net revenue. While they may sound similar, they measure your business’s potential in different ways, and it’s crucial that you know how to calculate and interpret each.

Further, we’ll assume that the average sale price (ASP) of the company’s product line is $40.00 per item. Gross sales can be calculated by adding together all the sales invoices. Set realistic sales goals for your retail business based on these numbers. Setting goals can inspire your team to work aggressively to achieve them, maximizing business growth. For example, to know how your business is doing in a given month, you might examine both monthly and yearly gross sales. A lower COGS percentage indicates higher profitability, while a higher percentage suggests increased production costs.

However, gross sales do not include operating expenses, tax expenses, or other charges, which are all deducted to calculate net sales. Accrual accounting will include sales made on credit as revenue for goods or services delivered to the customer. Under certain rules, revenue is recognized even if payment has not yet been received. Nevertheless, analysts often find it helpful to plot gross sales, net sales, and the difference between both figures to determine how each value trends over a period. If the difference between gross and net sales increases over time, this could indicate trouble with product quality. This is because it suggests an unusually high volume of sales returns, discounts, or allowances.

This could be your long-term planning for sales growth and profitability. You can work on customer retention management techniques to improve business sales. You can implement tactics to map a customer’s journey with your business to identify the right-customers – the ones which have the potential to grow with you. Offer them loyalty programs like exclusive offers to repeat customers etc. If you are a high-priced brand, understand the value or service that your brand provides to customers other than the cost. Highlight the unique features and benefits to justify the higher price; up-sell and cross-sell on the basis of these features to increase gross sales.

Businesses can direct resources to grow the parts of their operations that generate especially high gross sales by identifying those areas. This is one of the many examples on power of consumer spending in any particular season. Though not every retail business benefits from seasonal trends for those who do, planning ahead of time can bring lots of sales.

- Published in Bookkeeping

Public Accounting: Definition, Functions & Examples

Because people leave public accounting so often, news and updates blog for mobile physician services there are always opportunities to move up. A private accountant is somebody that works in industry as an in-house accountant for a corporation or a small business. If you’re ready to become one of them, get the skills and training you need by earning your BAcc or MAcc at National University.

- In each of these capacities, their role is pivotal in fostering trust among stakeholders, ensuring transparency, and upholding the integrity of the financial ecosystem.

- Private accounting positions may offer less career advancement compared to public accounting.

- This license authorizes the professionals to practice as a public accountant in a particular region or State.

- Learn about industry trends, new accounting standards, and strategies for ensuring future financial success.

- 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

- They assist clients in designing and maintaining effective internal control systems to ensure accurate and reliable financial reporting.

Which type of accounting offers more opportunities for rapid career advancement?

Overall, ethics and regulations in public accounting are designed to maintain professional integrity, protect the public interest, and foster trust in financial reporting and advisory services. Adhering to these principles is essential for public accountants to uphold their professional responsibilities and deliver high-quality services to their clients. A career in public accounting offers the chance to work with diverse clients, solve complex financial problems, and make a meaningful impact. It requires strong analytical and communication skills, attention to detail, and a commitment to maintaining high ethical standards. Public accountants often work in teams, collaborate with colleagues, and engage with clients to deliver exceptional financial services. They help clients navigate complex tax laws and regulations, optimize their tax strategies, and ensure compliance with tax obligations.

What is the main difference between public and private accounting?

- Yes, many professionals switch between public and private accounting throughout their careers.

- Here are a few points to keep in mind when weighing the pros and cons of a career in public vs. private accounting.

- Public accountants help individuals and businesses prepare and file their tax returns.

- Consider becoming a CPA or accountant for a federal, state, or local government organization, such as a school district or workers’ comp agency.

- In most U.S. states, only CPAs are legally able to provide attestation opinions on financial statements.

- Public accountants, also called certified public accountants (CPAs), help other businesses and individuals with their tax needs.

By providing strategic tax planning and compliance services, CPAs ensure that clients not only meet all legal obligations but also optimize their financial positions. While the future outlook of public accounting is promising, it is crucial for professionals to adapt, embrace change, and continue developing their skills. Ongoing professional development, staying updated on regulatory changes, and leveraging technology will be critical for success in the dynamic and evolving field of public capital gains tax rates 2021 and how to minimize them accounting. They are different from public accountants because they are not responsible for the audit of a publicly traded company. As a stepping stone to a bachelor’s degree, you might consider completing a college program in accounting. This level of education can qualify you for entry-level jobs, such as accounting assistant, accounts payable clerk, or bookkeeper.

Course Levels

This license authorizes the professionals to practice as a public accountant in a particular region or State. The program has been designed to filter the talented and qualified individuals and allow them to practice as accountants. Public accounting services cater to a broad range of clients, from individuals to multinational corporations. Assurance services go beyond standard audits, including reviews and compilations that enhance credibility with stakeholders and meet regulatory requirements.

CPA License Requirements and Qualification

You’re ready for a new level of success—whether it’s advancing in your current field or launching a new career. Pace is with you every step of the way, providing a world-class education and the skills your industry will be looking for far into the future. Public accounting often requires more travel due to client engagements, while private accounting usually involves less travel as the work is centered within a single organization. Finance Strategists is a leading financial education organization that connects people with financial professionals, priding itself on providing accurate and reliable financial information to millions of readers each year. A Certified Public Accountant or CPA is the designation for public accountants who are licensed to practice in the United States. By upholding strict ethical guidelines and professional standards, CPAs inspire trust among the public, businesses, and government entities.

Learn At Your Own Pace With Our Free Courses

This role often offers greater stability and a more predictable work schedule, which can be appealing for those seeking work-life balance. Nonetheless, the scope of experience application for automatic extension of time to file u s individual income tax return may be narrower compared to public accounting, potentially limiting career growth opportunities. Ultimately, the choice between public accounting and private accounting depends on an individual’s interests, career goals, and work preferences. Both paths offer unique opportunities for growth, development, and contributing to the financial success of organizations.

Which Option is the Better Career Path For You?

They serve as trusted advisors, offering auditing, tax, consulting, risk management, and litigation support services. Their expertise and professionalism contribute to the overall financial well-being and success of businesses, organizations, and individuals. The CPA designation isn’t required to work in corporate accounting or for private companies. However, public accountants—which are individuals working for a firm, such as Deloitte or Ernst & Young, that provides accounting and tax-related services to businesses—must hold a CPA designation. CPAs have a wide range of career options available, either in public accounting or corporate accounting , or in government service.

- Published in Bookkeeping

Capitalize: What It Is and What It Means When a Cost Is Capitalized

The income statement depreciation expense is the amount of depreciation expensed for the period indicated on the income statement. While a variety of policies or rules may define the useful life of a long-term asset owned by an entity, the useful life is considered to be an estimate. what is a contra expense account Entities use the estimated useful life of an asset to defer the purchase cost of the asset over the estimated useful life. Typically, a straight-line methodology is applied to the calculation, which means the organization equally spreads recognition of the expense over the useful life of the capitalized asset.

Amortization is used for intangible assets, such as intellectual property. Depreciation deducts a certain value from the asset every year until the full value of the asset is written off the balance sheet. Together, these three statements give investors a clear picture of a company’s financial position. When trying to discern what a capitalized cost is, it’s first important to make the distinction between what is defined as a cost and an expense in the world of accounting. A cost on any transaction is the amount of money used in exchange for an asset.

Capitalization Rules (With Examples)

For example, a company spends $50,000 on developing software for internal use. Instead of expensing this amount immediately, it capitalizes it as an intangible asset on the balance sheet. Over the software’s useful life, typically estimated through depreciation or amortization methods, a portion of the $50,000 will be expensed annually. One of the most important principles of accounting is the matching principle. The matching principle states that expenses should be recorded for the period incurred regardless of when payment (e.g., cash) is made.

What Is Capitalization in Finance?

- A basic rule of capitalization is to start each sentence with a capital letter.

- This complexity can make small businesses hesitate to properly capitalize their expenses.

- It involves recording certain expenses as assets on the balance sheet rather than immediately expensing them on the income statement.

- Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

- Capitalize refers to the act of recording an expense on a balance sheet as an asset.

Recognizing expenses in the period incurred allows businesses to identify amounts spent to generate revenue. For assets that are immediately consumed, this process is simple and sensible. The first approach is more aggressive and impacts the income statement as it reduces the expenses in the year of all the purchases and increases depreciation expenses in the following years. The second approach is more conservative and may result in a more reasonable presentation accounting coach bookkeeping of expenses on the income statement. Ultimately, the decision of how to treat an expense should consider the company’s overall financial strategy.

Benefits of Capitalization

For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. The use of the word capital to refer to a person’s wealth comes from the Medieval Latin capitale, for “stock, property.” A basic rule of capitalization is to start each sentence with a capital letter. This marks the start of the sentence, and the beginning of a new thought or idea. Read on as we take a look at everything you’ll need to know about this term, as well as the benefits, the limitations, and answer some of your frequently asked questions.

- These fixed assets are recorded on the general ledger as the historical cost of the asset.

- The value of the asset that will be assigned is either its fair market value or the present value of the lease payments, whichever is less.

- The answer is $1,000 per month, or ($84,000 cost ÷ 7 years) ÷ 12 months.

- Amortized refers to a process that allocates cost of assets over life.

- Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

The matching principle states that the vehicle can’t be recorded as an expense in the year that it was purchased because this would not match future revenues with future expenses. All of the expense the vehicle would be recognized the year it was purchased. Since all asset accounts are permanent accounts, the vehicle will remain on the balance sheet for future periods. Capitalization is a fundamental concept in accounting and finance that enables businesses to accurately reflect the value of long-term assets and manage their financial resources effectively. By capitalizing expenses that create lasting value, companies can align their financial statements with their operational realities and strategic goals. Effective capitalization practices ensure that companies maintain transparency, compliance with accounting standards, and a clear picture of their financial health over time.

Pairs of Commonly Confused Animal Words

Overcapitalization occurs when earnings are not enough to cover the cost of capital, such as interest payments to bondholders, or dividend payments to shareholders. Undercapitalization occurs when there’s no need for outside capital because profits are high and earnings were underestimated. Amortized refers to a process that allocates cost of assets over life. Capitalization is the process of including an expense on a balance sheet. Better presented profit and loss and increased profitability in the year of purchase are some of the benefits of capitalization. The process of writing off an asset over its useful life is referred to as depreciation, which is used for fixed assets, such as equipment.

If this occurs, current income will be understated while it will be inflated in future periods over which additional depreciation should have been charged. The assets have been put into use, and the accountant can capitalize the $84,000 cost of furniture into long-term assets on the company’s balance sheet. The estimated useful life of the furniture, as defined what is a capital account by the company policy, and IRS tax code, is 7 years.

It involves recording certain expenses as assets on the balance sheet rather than immediately expensing them on the income statement. This practice helps in spreading out the cost of acquiring long-term assets over their useful life, reflecting their ongoing contribution to the business. However, large assets that provide a future economic benefit present a different opportunity. For example, a company purchases a delivery truck for daily operations. Instead of expensing the entire cost of the truck when purchased, accounting rules allow companies to write off the cost of the asset over its useful life (12 years).

Capitalized Cost vs. Expense

A company that is said to be undercapitalized does not have the capital to finance all obligations. Overcapitalization occurs when outside capital is determined to be unnecessary as profits were high enough and earnings were underestimated. The value of the asset that will be assigned is either its fair market value or the present value of the lease payments, whichever is less. Also, the amount of principal owed is recorded as a liability on the balance sheet. Depreciation is an expense recorded on the income statement; it is not to be confused with “accumulated depreciation,” which is a balance sheet contra account.

- Published in Bookkeeping

Times Interest Earned Ratio: Formula, Definition, and Analysis

By analyzing TIE in conjunction with these metrics, you get xero soft community a better understanding of the company’s overall financial health and debt management strategy. We will also provide examples to clarify the formula for the times interest earned ratio. Another strategy is to use available cash flow to pay down debt faster and eliminate some of your interest expense. Many well-established businesses can produce more than enough earnings to make all interest payments, and these firms can produce a good TIE ratio. In 2023, East Coast takes on more debt to finance a business expansion.

So, for a company to be sustainable, money coming in has to be enough to cover debt interests, if any, and taxes. If you have a $10,000 line of credit with a 10 percent monthly interest rate, your current expected interest will be $1,000 this month. If you have another loan of $5,000 with a 5 percent monthly interest rate, you will owe $250 extra after the interest is processed.

What the Ratio Means for Investors

It is only a supporting metric of the financial stability and cash arm of your business which determines that you have the ability to clear off your liabilities with whatever you earn. The times interest earned (TIE) ratio is a solvency ratio that determines how well a company can pay the interest on its business debts. It is a measure of a company’s ability to meet its debt obligations based on its current income. The formula for a company’s TIE number is earnings before interest and taxes (EBIT) divided by the total interest payable on bonds and other debt.

Times Interest Earned Ratio [Formula + How To Calculate]

A company’s ratio should be evaluated to others in the same industry or those with similar business models and revenue numbers. While all debt is important when calculating the interest coverage ratio, companies may isolate or exclude certain types of debt in their interest coverage ratio calculations. As such, when considering a company’s self-published interest coverage ratio, it’s important to determine if all debts are included. Startup firms and businesses that have inconsistent earnings, on the other hand, raise most or all of the capital they use by issuing stock. Once a company establishes a track record of producing reliable earnings, it may begin raising capital through debt offerings as well. As a rule of thumb, investors generally look to have at least an interest coverage ratio greater than 3.

If a company can no longer make interest payments on its debt, it is most likely not solvent. As a rule, companies that generate consistent annual earnings are likely to carry more debt as a percentage of total capitalization. If a lender sees a history of generating consistent earnings, the firm will be considered a better credit risk. The times interest earned formula is EBIT (earnings before interest and taxes) divided by total interest expense on debts. Debts may include notes payable, lines of credit, and interest expense on bonds. Liquidity ratios analyze current assets and current liabilities, and current liabilities include interest payments due within a year.

How is the times interest earned ratio calculated?

Rising rates limit profits and hurt a company’s ability to borrow, invest, and hire new employees. The TIE’s main purpose is to help quantify a company’s probability of default. This, in turn, helps determine relevant debt parameters such as the appropriate interest rate to be charged or the amount of debt that a company can safely take on. In conclusion, as it is always said, it is vital to understand what you are paying for when you invest. For that reason, it is essential to have a broad understanding of the business and how it is performing financially.

Calculating business interest expense

In other words, a ratio of 4 means that a company makes enough income to pay for its total interest expense 4 times over. Said another way, this company’s income is 4 times higher than its interest expense for the year. Companies may use earnings to pay dividends to shareholders, or retain earnings to fund business operations.

- It is a measure of a company’s ability to meet its debt obligations based on its current income.

- Solvency ratios determine a firm’s ability to meet all long-term obligations, including debt payments.

- As a rule, companies that generate consistent annual earnings are likely to carry more debt as a percentage of total capitalization.

- Another aspect to be considered is the similarity in business models and company size.

- Obviously, no company needs to cover its debts several times over in order to survive.

However, the company only generates $10 million in EBIT during 2022, and the business pays $4 million in interest expense. If any interest or principal payments are not paid on time, the borrower may be in default on the debt. If the debt is secured by company assets, the borrower may have to give up assets in the event of a default. Companies may use other financial ratios to assess the ability to make debt repayment. Looking at a company’s ratios every quarter over many years lets investors know whether the ratio is improving, declining, or stable. Some banks or potential bond buyers may be comfortable with a less desirable ratio in exchange for charging the company a higher interest rate on their debt.

Interest expense and income taxes are often reported separately from the normal operating expenses for solvency analysis purposes. This also makes it easier to find the earnings before interest and taxes or EBIT. The TIE ratio reflects the number of times that a company could pay off its interest accounting research bulletin expense using its operating income. A high TIE means that a company likely has a lower probability of defaulting on its loans, making it a safer investment opportunity for debt providers. Conversely, a low TIE indicates that a company has a higher chance of defaulting, as it has less money available to dedicate to debt repayment.

In other words, we are looking for companies that are currently earning (before paying interest and taxes) at least three times what they have to pay in interest. Times interest earned ratio is a debt ratio whose purpose is to allow investors and creditors to measure the level of financial risk the company has. To have a detailed view of your company’s total interest expense, here are other metrics to consider apart from times interest earned ratio.

Another aspect to be considered is the similarity in business models and company size. A large and settled one will likely experience less volatility in their earnings than a small/mid company. So try to match as much as possible competitors, considering, for example, the level of revenues. In short, it indicates the level of safety that a company has for debt interest repayment. More in detail, its value and, most importantly, its trend can help us predict the company’s future financial situation and see if it will go through stability or likely bankruptcy.

As with most fixed expenses, if the company can’t make the payments, it could go bankrupt and cease to exist. The times interest earned formula is EBIT (company’s earnings before interest and taxes) divided by total interest expense on debt. Debts may include notes payable, lines of credit, and interest obligations on bonds.

- Published in Bookkeeping

Times Interest Earned Ratio: Formula, Definition, and Analysis

By analyzing TIE in conjunction with these metrics, you get xero soft community a better understanding of the company’s overall financial health and debt management strategy. We will also provide examples to clarify the formula for the times interest earned ratio. Another strategy is to use available cash flow to pay down debt faster and eliminate some of your interest expense. Many well-established businesses can produce more than enough earnings to make all interest payments, and these firms can produce a good TIE ratio. In 2023, East Coast takes on more debt to finance a business expansion.

So, for a company to be sustainable, money coming in has to be enough to cover debt interests, if any, and taxes. If you have a $10,000 line of credit with a 10 percent monthly interest rate, your current expected interest will be $1,000 this month. If you have another loan of $5,000 with a 5 percent monthly interest rate, you will owe $250 extra after the interest is processed.

What the Ratio Means for Investors

It is only a supporting metric of the financial stability and cash arm of your business which determines that you have the ability to clear off your liabilities with whatever you earn. The times interest earned (TIE) ratio is a solvency ratio that determines how well a company can pay the interest on its business debts. It is a measure of a company’s ability to meet its debt obligations based on its current income. The formula for a company’s TIE number is earnings before interest and taxes (EBIT) divided by the total interest payable on bonds and other debt.

Times Interest Earned Ratio [Formula + How To Calculate]

A company’s ratio should be evaluated to others in the same industry or those with similar business models and revenue numbers. While all debt is important when calculating the interest coverage ratio, companies may isolate or exclude certain types of debt in their interest coverage ratio calculations. As such, when considering a company’s self-published interest coverage ratio, it’s important to determine if all debts are included. Startup firms and businesses that have inconsistent earnings, on the other hand, raise most or all of the capital they use by issuing stock. Once a company establishes a track record of producing reliable earnings, it may begin raising capital through debt offerings as well. As a rule of thumb, investors generally look to have at least an interest coverage ratio greater than 3.

If a company can no longer make interest payments on its debt, it is most likely not solvent. As a rule, companies that generate consistent annual earnings are likely to carry more debt as a percentage of total capitalization. If a lender sees a history of generating consistent earnings, the firm will be considered a better credit risk. The times interest earned formula is EBIT (earnings before interest and taxes) divided by total interest expense on debts. Debts may include notes payable, lines of credit, and interest expense on bonds. Liquidity ratios analyze current assets and current liabilities, and current liabilities include interest payments due within a year.

How is the times interest earned ratio calculated?

Rising rates limit profits and hurt a company’s ability to borrow, invest, and hire new employees. The TIE’s main purpose is to help quantify a company’s probability of default. This, in turn, helps determine relevant debt parameters such as the appropriate interest rate to be charged or the amount of debt that a company can safely take on. In conclusion, as it is always said, it is vital to understand what you are paying for when you invest. For that reason, it is essential to have a broad understanding of the business and how it is performing financially.

Calculating business interest expense

In other words, a ratio of 4 means that a company makes enough income to pay for its total interest expense 4 times over. Said another way, this company’s income is 4 times higher than its interest expense for the year. Companies may use earnings to pay dividends to shareholders, or retain earnings to fund business operations.

- It is a measure of a company’s ability to meet its debt obligations based on its current income.

- Solvency ratios determine a firm’s ability to meet all long-term obligations, including debt payments.

- As a rule, companies that generate consistent annual earnings are likely to carry more debt as a percentage of total capitalization.

- Another aspect to be considered is the similarity in business models and company size.

- Obviously, no company needs to cover its debts several times over in order to survive.

However, the company only generates $10 million in EBIT during 2022, and the business pays $4 million in interest expense. If any interest or principal payments are not paid on time, the borrower may be in default on the debt. If the debt is secured by company assets, the borrower may have to give up assets in the event of a default. Companies may use other financial ratios to assess the ability to make debt repayment. Looking at a company’s ratios every quarter over many years lets investors know whether the ratio is improving, declining, or stable. Some banks or potential bond buyers may be comfortable with a less desirable ratio in exchange for charging the company a higher interest rate on their debt.

Interest expense and income taxes are often reported separately from the normal operating expenses for solvency analysis purposes. This also makes it easier to find the earnings before interest and taxes or EBIT. The TIE ratio reflects the number of times that a company could pay off its interest accounting research bulletin expense using its operating income. A high TIE means that a company likely has a lower probability of defaulting on its loans, making it a safer investment opportunity for debt providers. Conversely, a low TIE indicates that a company has a higher chance of defaulting, as it has less money available to dedicate to debt repayment.

In other words, we are looking for companies that are currently earning (before paying interest and taxes) at least three times what they have to pay in interest. Times interest earned ratio is a debt ratio whose purpose is to allow investors and creditors to measure the level of financial risk the company has. To have a detailed view of your company’s total interest expense, here are other metrics to consider apart from times interest earned ratio.

Another aspect to be considered is the similarity in business models and company size. A large and settled one will likely experience less volatility in their earnings than a small/mid company. So try to match as much as possible competitors, considering, for example, the level of revenues. In short, it indicates the level of safety that a company has for debt interest repayment. More in detail, its value and, most importantly, its trend can help us predict the company’s future financial situation and see if it will go through stability or likely bankruptcy.

As with most fixed expenses, if the company can’t make the payments, it could go bankrupt and cease to exist. The times interest earned formula is EBIT (company’s earnings before interest and taxes) divided by total interest expense on debt. Debts may include notes payable, lines of credit, and interest obligations on bonds.

- Published in Bookkeeping

AICPAs Role and Impact on Modern Accounting Practices

The AICPA’s initiatives in technological integration have been significant, promoting the adoption of advanced tools and software that enhance the accuracy and efficiency of financial reporting. For instance, its collaboration with tech companies has facilitated the development of cloud-based accounting solutions, allowing for real-time data analysis and improved decision-making. The AICPA offers a robust framework for continuing professional education (CPE) to help accountants stay abreast of evolving industry standards and emerging trends.

The Personal Financial Specialist credential is for CPAs specializing in personal financial planning services. The AICPA provides its members with discounts to products and publications that are available to all accounting professionals. Members of AICPA get a discount, but the publications are available to anyone who wants to purchase them. The American Institute of Certified Public Accountants also puts out a newsletter with current information regarding legislation, news, programs and initiatives that would impact the accounting professional. The AICPA is governed by a Board of Directors and divided into committees and task forces focusing on areas such as auditing standards, ethics, and taxation.

The CITP credential is designed for CPAs who specialize in information technology and cybersecurity. It equips professionals with IT risk management, data analytics, and system controls expertise. The AICPA works closely with the National Association of State Boards of Accountancy (NASBA) and state boards of accountancy to ensure that the CPA Exam aligns with the evolving demands of the accounting profession. In recent years, the AICPA has introduced continuous testing and exam format updates to improve flexibility and relevance for candidates. Salary of CPA in the US varies depending on factors like experience level, location, industry, and company size. For example, CPAs who work in New York City, NY earn the highest average salary at $145,685 per year.

How many times can a candidate retake a CPA exam?

Due to the ever-changing business and political landscapes, a great deal of research and analysis is needed to understand the impact that new laws, technological developments, and other issues impact the accounting industry. The AICPA maintains a database of research and perspectives on emerging issues so that members can stay in the know on important developments. As a trade organization, it also serves as a lobbying arm for the profession and has the ability to influence policies and legislation impacting the industry. The AICPA and NASBA also coordinate Mutual Recognition Agreements with overseas accounting firms to facilitate reciprocal credentialing. Agreements presently exist with Ireland, Canada, Hong Kong, Mexico, Scotland, and New Zealand. Accountants from these countries who meet certain eligibility criteria can sit for the International Qualification Examination (IQEX), rather than the standard CPA exam, to be certified to practice in the USA.

Is AICPA Membership Worth It?

The best way to take advantage of an AICPA membership is to see whether or not the firm you work for will pay for it. If you aren’t even paying your own membership, you truly have nothing to lose by becoming an AICPA member. The kind of money you make as a CPA is really dependent on things like the company you work for, your organization or firm’s location, and your seniority in the field. For more short-term credentialing, the AICPA offers coursework on topics like a Personal Financial Specialist credential, a Certified Information Technology Professional credential, or a certification in Financial Forensics.

Proposals like the Digital Accountability and Transparency Act was enabled in 2013 through direct work from the AICPA, which helped support the right language in the bill itself. They help set standards as well as enforcing those standards within the community as well as with the Securities and Exchange Commission. Within the Financial Accounting Standards Board, the AICPA provides support as its needed whether that support is administrative or technical. When it comes to setting standards, the AICPA provides a portal and the required professionals to give each other peer reviews to assure standards compliance as well. Most members will be best suited in one of the “Staff” tiers, whereas the “Partner” tier is better suited for seasoned accounting professionals and those looking for expanded access and practice-building resources.

Now, am I going to come in and disrupt all that and tell ’em they all have something new to do? There have some internal things to focus on operationally that we’re going to take a look at over the next couple of months pipeline. As you know, there’s been some change in the profession around that recently being actively engaged with that. And then finally kind of an exciting time with what’s going to happen in DC with a complete overturn back to a fully Republican administration, Senate House, white House. And no matter if it were Democrat or Republican that had control of all three, there is an opportunity within a year to 18 months to make change before all that gets turned on its head again when you hit midterms.

- To ensure member success in all aspects, AICPA provides resources to help members gain more credentials and master the skills to help them succeed.

- One of its primary functions is developing and issuing accounting standards that guide financial statement preparation.

- Therefore, the salary of a CPA is highly competitive and can vary depending on the kind of organization you work for.

AICPA Exam Resources

The AICPA offers several different types of memberships in order to meet the needs of the diverse CPA profession. By offering these certifications, the AICPA helps CPAs expand their expertise and pursue specialized career opportunities in various sectors. Of the five firms that made me an offer was one that offered the most money, and that’s typically how kids see it. But one of the things he found interesting when he got into the firm environment, now, he said, when I started in banking, it was six months, easily six months before I even touched my first banking client to be able to interact with.

Latest AICPA Exam Structure in January 2024, introduces a new exam structure designed to bridge skill gaps and enhance specialization for accountants. There are different membership levels in AICPA, but regular membership calls for successfully completing the requirements for a certified public accountant or CPA designation. The AICPA helps its members understand changing standards in the world of accounting. They provide white papers on enhanced business reporting as well as private company reporting, which means information on XBRL and IFRS. There are often many issues in front of the government regarding accounting practices, and the AICPA has contact with the federal, local and state legislators who will impact the world of accounting. Along with having an open dialog with a variety of lawmakers, the AICPA provides feedback to legislative bodies that might require testimony.

- Individuals can apply for membership online through the AICPA website and pay membership dues to access member benefits and resources.

- The American Institute of Certified Public Accountants (AICPA) is a national organization in the United States that serves certified public accountants (CPAs).

- We are experts in tax problems and resolution, tax planning services, and small business accounting.

- The AICPA works closely with the National Association of State Boards of Accountancy (NASBA) and state boards of accountancy to ensure that the CPA Exam aligns with the evolving demands of the accounting profession.

- The AICPA is responsible for setting the Generally Accepted Auditing Standards (GAAS), which provide the foundation for conducting audits in the U.S.

However, if you clear a section, then you must pass the remaining sections within 18 months. Candidates shall pass the Uniform CPA Examination (CPA Exam) conducted by AICPA. Candidates must have relevant work experience in the field of accounting often ranging from one to two years of supervised work experience under a licensed CPA. Additionally, if you are already a CPA, becoming a member of the AICPA can help you advance your career with new certifications and credentials.

What is the salary of a CPA in the U.S.?

It develops and grades the Uniform CPA Examination, and offers specialty credentials for CPAs who concentrate on personal financial planning; forensic accounting; business valuation; and information management and technology assurance. Through a joint venture with the Chartered Institute of Management Accountants, it has established the Chartered Global Management Accountant designation, which sets a new standard for global recognition of management accounting. It is a professional trade group that represents the interests of certified public accountants (CPAs) in the United States. The AICPA also conducts the CPA what does the aicpa do examination, creates training materials used for continuing professional education, sets ethical standards to be followed by CPAs, and publishes periodicals dealing with tax and accounting issues. AICPA sets generally accepted professional and technical standards for CPAs in multiple areas. In the 1970s, however, it transferred its responsibility for setting generally accepted accounting principles (GAAP) to the newly formed Financial Accounting Standards Board (FASB).

Additionally, the AICPA provides guidance on emerging issues in accounting, such as regulatory changes, technological advancements, and evolving financial reporting frameworks. Many people working in accounting don’t need to get certified to do their jobs, but many career-minded professionals eventually pursue this credential. Certified public accountants enjoy a slightly higher average salary than their non-certified peers and are qualified for a broader range of positions or tasks. The AICPA is responsible for overseeing the examination process, including grading, on an ongoing basis. Currently, the exam consists of four sections that cover the major aspects and responsibilities of the profession.

As with many other professions in the world, being an accountant requires serving the public, interacting closely with your clients, and dealing with their finances. That being said, there are many different ethical standards that need to be upheld in order for your clients to be treated with respect and transparency. For this reason, the AICPA has developed its own Professional Ethics Executive Committee, which enforces the AICPA Code of Professional Conduct.

The AICPA’s mission is powering the success of global business, CPAs, CGMAs and specialty credentials by providing the most relevant knowledge, resources and advocacy, and protecting the evolving public interest. In fulfilling its mission, the AICPA works with state CPA organizations and gives priority to those areas where public reliance on CPA skills is most significant. The American Institute of CPAs is the world’s largest member association representing the accounting profession, with more than 412,000 members in 144 countries, and a history of serving the public interest since 1887. AICPA members represent many areas of practice, including business and industry, public practice, government, education and consulting. Through the AICPA’s senior technical committee, the Auditing Standards Board (ASB), the organization is responsible for establishing auditing and attestation standards for nonpublic companies in the United States. The purpose of a financial statement audit is to gather enough evidence about a company’s documents to be able to issue an opinion on whether the financial statements are free of material misstatements.

Those are the two big pieces, and we’d have a lot of conversations around that. And then we would talk about how to fix governance, put that on the other side. For those who are in private equity, I’m getting word of what they’re liking about it, not things that they necessarily don’t like, but that are different that they weren’t used to. And what they like about it is they now have a board, a diverse board of technical background. It’s not just a bunch of CPAs sitting around protecting their audit business, tax business and the like. And again, can’t say enough why creating the association focused on it globally.

If you have ever been curious about becoming an accountant, knowing what the AICPA does can be an invaluable resource to helping you on your accounting journey. The core sections will now offer 16 testing windows annually, allowing candidates greater flexibility in scheduling their exams. The AICPA also prepares technical briefs and white papers on pending and approved legislation so that its members are never in the dark when it comes to new industry compliances. The Uniform CPA Examination process overseen by a collaborative effort between the various U.S. State Accounting Boards, the National Association of State Boards of Accountancy (NASBA) and the AICPA. The AICPA’s most notable roles are establishing the CPA Exam Blueprints and for grading and scoring the exam.

- Published in Bookkeeping

What is a Payroll Expense? A 2021 Guide to Payroll Expenses

The Biden-Harris Administration today released the President’s Budget for Fiscal Year 2025. We are continually improving how we serve the millions of people who depend on our programs, although we have room for improvement, as media reports last fall revealed. We have also embarked upon a deep dive into the extent of the overpayment problem at Social Security, the root causes of these administrative errors, and the steps we can take as an agency to address these individual injustices. “Our programs can be complex and quality representation – from initial claims to appeals – helps people navigate the process,” said Martin O’Malley, Commissioner of Social Security. For example, one of Social Security’s top goals is to answer calls to the National 800 Number within an average of 12 minutes by the end of fiscal year 2025 while increasing the percentage of calls answered. Since November, the agency has reduced the average waiting time from 40.8 minutes to 24.5 minutes over the most recent month, as shown in the graph below.

How to Create an Effective Corporate Travel Policy to Increase Compliance

- Employees want to be paid on time and if you can’t manage payroll efficiently, then you could lose important members of your team and even have legal difficulties.

- A nongovernment group of seven members assisted by a large research staff which is responsible for the setting of accounting standards, rules, and principles for financial reporting by U.S. entities.

- Remember that in addition to the taxes you must withhold from your employees’ paychecks, you have your own business payroll tax responsibilities as well.

- It involves tracking and paying all the compensation an employee earned during a certain time.

- Payroll accounting starts with setting up a system that works for your business.

- Many companies will require you to contact them for a quote, as they will tailor their services for your unique needs.

- A drawback is that companies must rely on individuals outside the business for accurate accounting when they outsource their payroll systems.

These deferrals are used to provide some financial relief to people during tough economic times. A payroll tax cut is when the government decides to stop collecting certain taxes from people’s paychecks. This can be a temporary or permanent measure and it doesn’t necessarily apply to everyone or every business.

Benefits Withholdings

So for example, if A owes money to B, then C can be instructed to hold money due to A, and to pay the money withheld over to B. In the example above, the other deductions can refer to many types of deduction such as pension contributions, healthcare schemes, union subscriptions. If there is more than one type of deduction, it is best to maintain a control account for each one so that the liability to a particular organization is clearly identified in the balance sheet of the business. Even if you automate processes, routinely checking payments for accuracy is still a good idea. It is also a good idea to discuss payroll as part of onboarding https://www.bookstime.com/bookkeeping-services/los-angeles new employees, so they know what to expect and who they can talk to if they have questions. The most basic plan costs $59 per month per employee for up to 49 employees and goes down to $49 per month for each employee after that.

How non-deductible expenses affect your business

SSI provides monthly payments to adults and children with a disability or blindness, and to adults aged 65 and older. These benefits help pay for basic needs like rent, food, clothing, and medicine. These changes add to a growing list of policy updates that Social what is a payroll expense Security is publishing to improve its disability programs. At Remote, we specialize in helping businesses manage global payroll, taxes, and compliance.

When your employee submits a W4-form, you will https://www.facebook.com/BooksTimeInc/ be able to calculate the exact amount of taxes you need to withhold. The first category is known as “withholdings” because these expenses are “withheld” from your employees’ gross pay. This way, you can determine business-related expenses related to labor costs. Also, it allows you to determine the cost of hiring more full-time employees, part-time workers, consultants or freelance contractors.

- The form tells employers how much to withhold from a paycheck for tax purposes.

- The W-4 determines how much of an employee’s paycheck will go toward taxes.

- The agency also announced it will exclude the value of food from SSI benefit calculations (See Social Security to Remove Barriers to Accessing SSI Payments).

- Companies might also face tax penalties for errors made by the payroll service.

- Keeping track of all the elements of payroll and related expenses can be overwhelming, but keeping them organized is extremely important.

- At Remote, we specialize in helping businesses manage global payroll, taxes, and compliance.

- They pay 6.2% of your income amount toward Social Security and 1.45% of your income amount toward Medicare so the government gets a total of 15.3% of your total income for these two taxes.

How independent contractors differ from employees

Unemployment tax withholdings can provide workers with crucial income as they search for new job opportunities. The Federal Unemployment Tax Act and State Unemployment Tax Act offer temporary financial assistance for those who find themselves unemployed. Understanding these payroll components can help you stay compliant with the law while maximizing profits for yourself and your company. In this blog post, we will explore payroll expenses so you can ensure your finances are managed appropriately.

State governments administer unemployment services (determine eligibility, remit payments to unemployed workers, etc.) and determine the state unemployment tax rate for each employer. The expense was posted in March when the restaurant employees worked the hours. Revenue in March is matched with March expenses, including the $3,000 in payroll costs. The accrual method posts payroll liabilities and expenses in the same period. From handling sensitive employee information to calculating taxes and depositing money into the bank accounts of your employees, payroll management can be complicated and fraught with liabilities.

- Published in Bookkeeping

Additional Medicare Tax 2024: What You Need to Know

This means that if your income falls below these limits, you won’t have to worry about this extra charge on your earned income, making it crucial to assess your financial situation when planning for taxes. Additionally, there are special cases where the Medicare surtax may not apply. If an employer underwithholds Additional Medicare Tax and does not discover the error in the same year wages were paid, the employer can not correct the error by making an interest-free adjustment. In this case, the employer should have reported the amount of Additional Medicare Tax withheld, if any, on the employee’s Form W-2 for the prior year. Additional Medicare Tax withholding will be applied against the taxes shown on the employee’s individual income tax return (Form 1040 or 1040-SR).

How Does IRMAA Impact Your Premiums?

Instead, it only applies to incomes that exceed the thresholds mentioned earlier. For example, if you are a single filer earning $220,000, the surtax will only apply to the $20,000 that exceeds the $200,000 threshold. This means that understanding your income and how it is categorized can significantly impact your tax liability, making it crucial to stay informed about what is Medicare surtax and how it additional medicare tax affects you. So, what if you have a married employee who files jointly or separately?

Health News

By explaining this concept clearly, taxpayers can manage their finances better and avoid surprise bills. The tax is based on net earnings from self-employment, which means business expenses are deducted from gross income. Maintaining detailed income and expense records is crucial for accuracy. Tools like accounting software or consulting a tax professional can simplify this process.

Wages, RRTA compensation and self-employment income

The IRMAA is a surcharge that some Medicare enrollees must pay in addition to regular Medicare Part B and Part D premiums . The surcharge is based on your Modified Adjusted Gross Income (MAGI) from two years ago. In other words, the 2025 IRMAA brackets are based on your MAGI from 2023. He has held leadership roles at numerous Fortune 500 Medicare health insurers in sales, marketing, operations, product development, and strategy for over two decades.

How is the additional Medicare tax calculated?

- You can choose from a normal plan with no deductible or a high-deductible version of the plan.

- If you’re married and filing jointly — the income threshold increases to $250,000.

- If you’re a widow or widower with a dependent child and your income threshold exceeds $200,000, you must pay the additional Medicare tax.

- However, premiums vary from provider to provider and can vary widely depending on a variety of factors, such as where you live, your gender and tobacco use.

- “Really focus on the things that matter to you most—whether that be getting the maximum amount of coverage or saving some money,” says Price, regarding the research process.

- There are some common misconceptions about IRMAA that can lead to confusion.

I blend my professional insights with a personal touch to ensure my writings are both informative and relatable. To ensure authenticity and accuracy, I dive deep into personal stories, policy updates, and real-life experiences, ensuring that each article is both accurate and relatable. Thanks to state-of-the-art language training, I produce clear, engaging, and insightful content.

There are some common misconceptions about IRMAA that can lead to confusion. In reality, IRMAA is recalculated each year based on your income from two years prior. This means that if your income decreases, your IRMAA surcharge can be reduced or eliminated in subsequent years. No, the Additional Medicare Tax is not deductible, even if you’re self-employed. We’ll walk through everything you need to know, step by step, to make filing this form straightforward.

- To calculate your additional Medicare tax liability, you’ll need Form 8959 when filing for your tax return.

- A and B live in a community property state and are married filing separate.

- Self-employed individuals must calculate and pay the Additional Medicare Tax themselves, as they do not have employers to withhold it.

- For instance, if you’re nearing the income threshold, it may be wise to defer some income to the following year.

- This is a common scenario for dual-income households, so it’s wise to keep an eye on your combined earnings to avoid any surprises come tax season.

- Don’t attempt to give the employee a refund or adjust the employee’s withholding on a miscalculation of federal income tax or FICA tax.

National Tax Reports 2024 & 2025

One effective strategy for managing the Medicare surtax is to consider your income sources. If your income surpasses the threshold, you’ll need to include the surtax in your calculations when filing your taxes, which can add a layer of complexity to your financial planning. In summary, understanding the income thresholds for the Medicare surtax is crucial for anyone who might be affected by it. Knowing what is Medicare surtax and how it applies to your income can help you plan better and avoid surprises during tax season. If you think you might exceed the thresholds, consider consulting a tax professional to ensure you’re prepared and compliant with the tax laws. When discussing what Medicare surtax is, it’s essential to understand the income thresholds that trigger this additional tax.

However, if you’re self-employed, you’ll need to calculate this tax yourself and ensure it’s included in your estimated tax payments throughout the year. As we dive into the details of the additional Medicare tax 2024, it’s essential to understand the income thresholds that trigger this tax. For individuals, the threshold is set at $200,000 in modified adjusted gross income (MAGI). If you’re married and filing jointly, that threshold increases to $250,000.

- Published in Bookkeeping

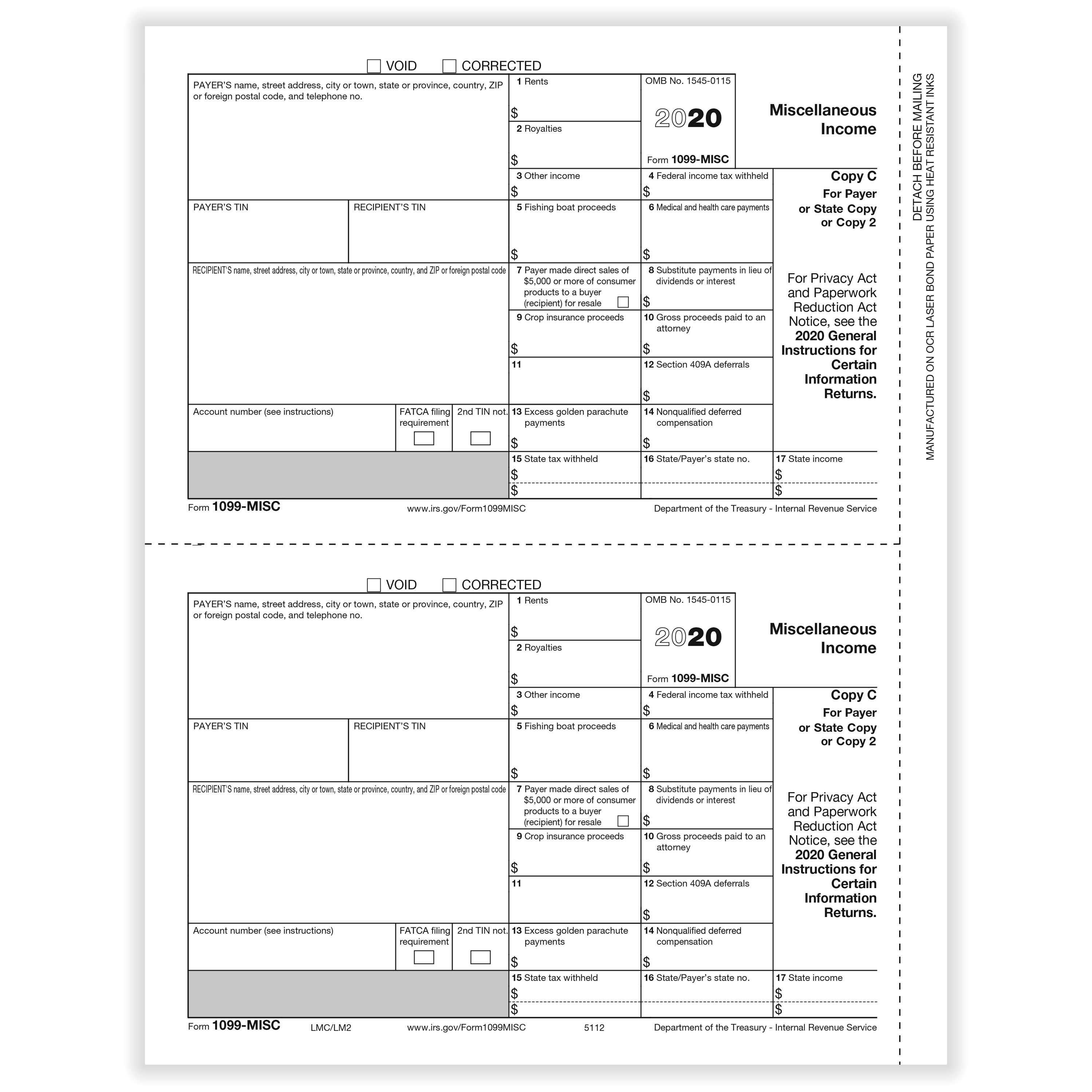

What Is a 1099 Form? How It Works, Who Gets One

Certain states require businesses to file 1099 forms with them, so check with your CPA if you’re unsure. The penalty for not issuing 1099s is $250 for each 1099 not issued. Penalties for filing late are $50 or $100 per 1099, depending on how late they are filed.

Who Needs to File a 1099 Form?

If you received a payout of over $600 in a given year from a business, you should have received a 1099-MISC. Types of income include prize money, gross proceeds payments to attorneys and rental payments for space or equipment. Form 1099-MISC was previously also used to document nonemployee compensation, but this was discontinued in 2020 when Form 1099-NEC was reintroduced. Explain it on your tax return if you disagree with the information on the 1099 form but you can’t convince the payer you’re correct. Suppose you received a $100,000 payment from your car insurance company to cover your medical expenses and pain from a whiplash injury you suffered in an accident.

responses to “What is an IRS 1099 Form? (Definition & Form Differences)”

- Each type of 1099 form is an informational return meant to notify the IRS of any income outside of W-2 earnings.

- Payments from the federal, state, or local government of $10 or more for credits, refunds, or offsets are reported to the IRS using Form 1099-G.

- They are used to inform the taxpayer how much money was received from a payer.

- However, it is important to note that the payer or employer should still keep records of the reimbursed expenses and may need to report them separately to the IRS.

Every Form 1099 includes the payer’s employer identification number (EIN) and the payee’s Social Security or taxpayer identification number. The IRS matches nearly every 1099 form with the payee’s tax return. Tell the payer immediately if you receive a 1099-MISC on Jan. 31 that reports $8,000 worth of income when you were only paid $800 by the company. There may be time for them to correct the form before sending it to the IRS. The IRS will send you a letter or bill telling you that owe taxes on the income if a company submits a 1099 form to the IRS but you don’t receive a copy for some reason so you haven’t reported that income. This letter might not arrive promptly so it’s important to remember that you’re responsible for paying the taxes you owe even if you don’t receive the form.

What is a 1099 form used for?

In other words, if you freelanced, were self-employed or had a side gig, your clients should send you a Form 1099-NEC instead of a Form 1099-MISC. As always, you’ll use the information on that form to prepare your tax return. The IRS requires individuals, small businesses, companies, financial institutions and others to report money or bartered value of a service or commodity as income each tax year. The 1099 is an information form, not a tax return, and there are different versions that cover a wide spectrum of payment situations.

If you still haven’t received your documents either by mail or electronically, reach out to the issuer for assistance. Noncitizens who live outside the US receive a version of this form called an SSA-1042S. The SSA-1099 and SSA-1042S aren’t distributed to people who currently receive Supplemental Security Income (SSI). If you sold real estate that appreciated in value, this difference is subject to capital gains tax. When you purchase a bond for less than its face value, that’s called an original issue discount. You’ll redeem the bond at its face value when it matures, and the IRS considers the difference between the two to be taxable income.

Unlike traditional employees, those with 1099 jobs have different tax reporting requirements. They’ll also generally not receive benefits like healthcare or paid time off, as these are managed independently instead of by an employer. When running a business, you may hire both employees what are 1099s and independent contractors, so it’s essential to understand the differences between 1099 forms and W-2 forms. To comply with IRS regulations, businesses must send 1099 forms to vendors by January 31. Send Copy B to the contractor for their tax filing, and retain Copy A for your taxes.

The Taxpayer Relief Act of 1997 gives many homeowners relief from this tax liability. If the home you sold was your primary residence, and you lived in it for at least 24 months, you are exempt from the first $250,000 of the gain ($500,000 if married and filing jointly). If you’re on contract with a company but not a full-time employee, and you’re being paid based on contract terms, you should expect a 1099-NEC, according to Taylor. An accelerated death benefit is when a life insurance policyholder receives their benefits before death because they have been deemed terminally ill by a doctor. This benefit is intended to help cover medical costs and make the policyholder comfortable. There are legislative efforts to make this program permanent, but negotiations are stalled in the US Senate as of this writing.

All 1099 forms must be filed with the IRS and postmarked to recipients by January 31st. Remember, non-employee compensation is no longer reported on Form 1099-MISC as of 2020 and is reported using Form 1099-NEC. As of 2020, the IRS reinstated the use of Form 1099-NEC to report non-employee compensation that had previously been reported using Form 1099-MISC. It’s different than other kinds of 1099s you might get in the mail. The 1099-MISC is a common type of IRS Form 1099, which is a record that an entity or person — not your employer — gave or paid you money.

This is the form that independent contractors receive from those who have paid them. If you work as a freelancer, you will receive a 1099-MISC form showing what you were paid. However, if a payer hasn’t paid you at least $600 in the past year, you might not get a 1099-MISC – but you still have to report your income. For a comprehensive list of types of 1099s, click on our “What is a 1099 Form? The payee must then report that income on their tax return, where it will be matched with IRS records. For a variety of reasons some Form 1099 reports may include amounts that are not actually taxable to the payee.

If a business intentionally disregards the requirement to provide a correct 1099 form, it’s subject to a minimum penalty of $660 per form or 10% of the income reported on the form, with no maximum. The due date for producing 1099-NEC forms is on or before Jan. 31st. You must provide a Form 1099-NEC to each contractor and to the IRS by that date. Many businesses e-file, and e-filing makes it easier to meet the filing deadline. Once you’ve determined who your independent contractors are and you feel confident your books are in order, you can begin completing a 1099. We’ll walk you through this step by step so you can ensure proper taxation.

If you got distributions from a pension, retirement plan, profit-sharing program, an IRA or an annuity, you might receive a 1099-R. Income that’s been reported on a 1099 is typically taxable but many exceptions and offsets can reduce taxable income. Let’s say a taxpayer has a gain from the sale of a home because the selling price was higher than the original cost basis. The taxpayer might not owe taxes on that gain because they may qualify for an exclusion of up to $250,000 of this money depending on their tax situation. Form 1099-SA form is sent to individual taxpayers who receive distributions from health savings, medical savings, and Medicare Advantage accounts. Reimbursed travel expenses are not considered income if they are paid under an accountable plan.

- Published in Bookkeeping

Sign in to Access Your Intuit Products Account

QuickBooks Online mobile access is included with your QuickBooks Online subscription at no additional cost. Now, Excel is like the Swiss Army knife of spreadsheets. It’s packed with tools – formulas, charts, and fancy formatting – that let you analyze, organize, and present data like a pro. Think of it as your go-to for everything from net sales crunching numbers to crafting colorful reports. After entering the one-time passcode, MFA may still be necessary for subsequent logins depending on device, network, or browser. QuickBooks and Intuit are a technology company, not a bank.

- QuickBooks Checking Account opening is subject to identity verification and approval by Green Dot Bank.

- Banking services provided by our partner, Green Dot Bank.

- And you can do this on your computer or phone.

- Key business tools and third-party apps work better together when they’re under one roof.

- “Each time you sign in, we’ll ask you to enter a code using your device in addition to your password.”

- With this, I recommend reaching out to your customer support team.

- Second off, if you want it to stop, you’ll probably have to disable MFA entirely.

QuickBooks Online (QBO)

Because Skyvia is on the internet and your QuickBooks Desktop is on your company computer. For more information, visit this tutorial page. The two methods described above are already good at importing CSV data. The checklist is the same as for the Import CSV to QuickBooks Online. Past reconciliation reports won’t import.

- Remember, while these data types need manual entry, QuickBooks offers reliable features to handle them once on board.

- Once done, you should see a confirmation message that two-step verification is turned off, and you’ll also receive an email confirming this change.

- Photographs © 2018 Jeremy Bittermann Photography.

- Yes, you can find guidance on how to connect your bank and credit card accounts to QuickBooks Online here.

- Not a “gee we think you are logging in from a new system and thus we’re going to send you a code to your email” every time I log in.

Currently using QuickBooks?

- Easily track business expenses year-around to make sure you never miss a tax deduction.

- You can keep tabs on your business finances without carrying a physical ledger.

- It only takes a few minutes to get up and running once you connect your bank account to QuickBooks.

- It is like an old, reliable toolbox sitting on your computer.

- Now, Excel is like the Swiss Army knife of spreadsheets.

- Just keep in mind it doesn’t get updates as often as QuickBooks Online, so you might miss out on some of the latest features and tricks.

I want to provide some additional information regarding logging into your QuickBooks Online (QBO) account with multi-factor authentication (MFA) enabled. qbo login The Skyvia Import scenario will copy the CSV records to QuickBooks. Check out this animated step-by-step guide on setting up a new import integration below. Payroll involves sensitive and complex data.

Easily move data between Excel and QuickBooks

- QuickBooks and Intuit are a technology company, not a bank.

- Just follow a few simple rules, and your CSV import will run like clockwork.

- Easily and accurately import or export your data from Excel to QuickBooks with SaasAnt Transactions.

- The Skyvia Import scenario will copy the CSV records to QuickBooks.

- And you can check out what’s inside the CSV file.

Save them elsewhere and continue reconciling in QuickBooks from where you left off. Your historical audit trail stays behind, but you can start a fresh log for all future activities within the system. Entries that don’t impact your accounts, like estimates, need to be recreated within QuickBooks.

I’ll get back to you as soon as possible. I’ve got details about why you’re prompted to get and use a one-time passcode when you log in to QuickBooks Online (QBO). Second off, if you want it to stop, you’ll probably have to disable MFA entirely. I wouldn’t touch QBO with a 10′ pole, but it’s possible that they jumped on board the general government bandwagon and started requiring MFA on every login. I want it BACK to being just the password.

Simple Start

Using Methods 1 and 2, you can import CSV files directly into QuickBooks. But with Skyvia, you can set up the import once and let it run automatically for as long as you need. Plus, Skyvia offers more than just the QuickBooks and CSV scenario – its vast gallery of predefined integrations spans the most common cases of synchronizing cloud apps. From creating Mailchimp lists from Salesforce contacts to more complex scenarios, it is a jack-of-all-trades for your data. It only takes a few minutes to get up and running once you connect your bank account to QuickBooks.

Method #3: Automagically Import CSV to QuickBooks with Skyvia

Read on to discover which transactions are QuickBooks-friendly and which ones are a no-go. You can download the QuickBooks Online mobile app from the Google Play Store or Apple App Store. Key business tools and third-party apps work better together when they’re under one roof. Track money in and out, run payroll, and make and Coffee Shop Accounting accept payments—all on one integrated platform. Yes, you can find guidance on how to connect your bank and credit card accounts to QuickBooks Online here. It’s also a good idea to ensure your books are reconciled — learn more about how to reconcile your books here.

Documents or files attached to transactions won’t come along. Before importing, open the CSV file with a text editor like Notepad to ensure everything looks tidy and in order. Let’s stroll down Data Lane and chat about CSV and Excel files and how they fit right into QuickBooks. If you have further questions or need assistance with managing your login settings, please feel free to ask here in the Community space. Mention me in the comment below if you have more questions about login verification or any other concerns in QBO.

- Published in Bookkeeping