Certain states require businesses to file 1099 forms with them, so check with your CPA if you’re unsure. The penalty for not issuing 1099s is $250 for each 1099 not issued. Penalties for filing late are $50 or $100 per 1099, depending on how late they are filed.

Who Needs to File a 1099 Form?

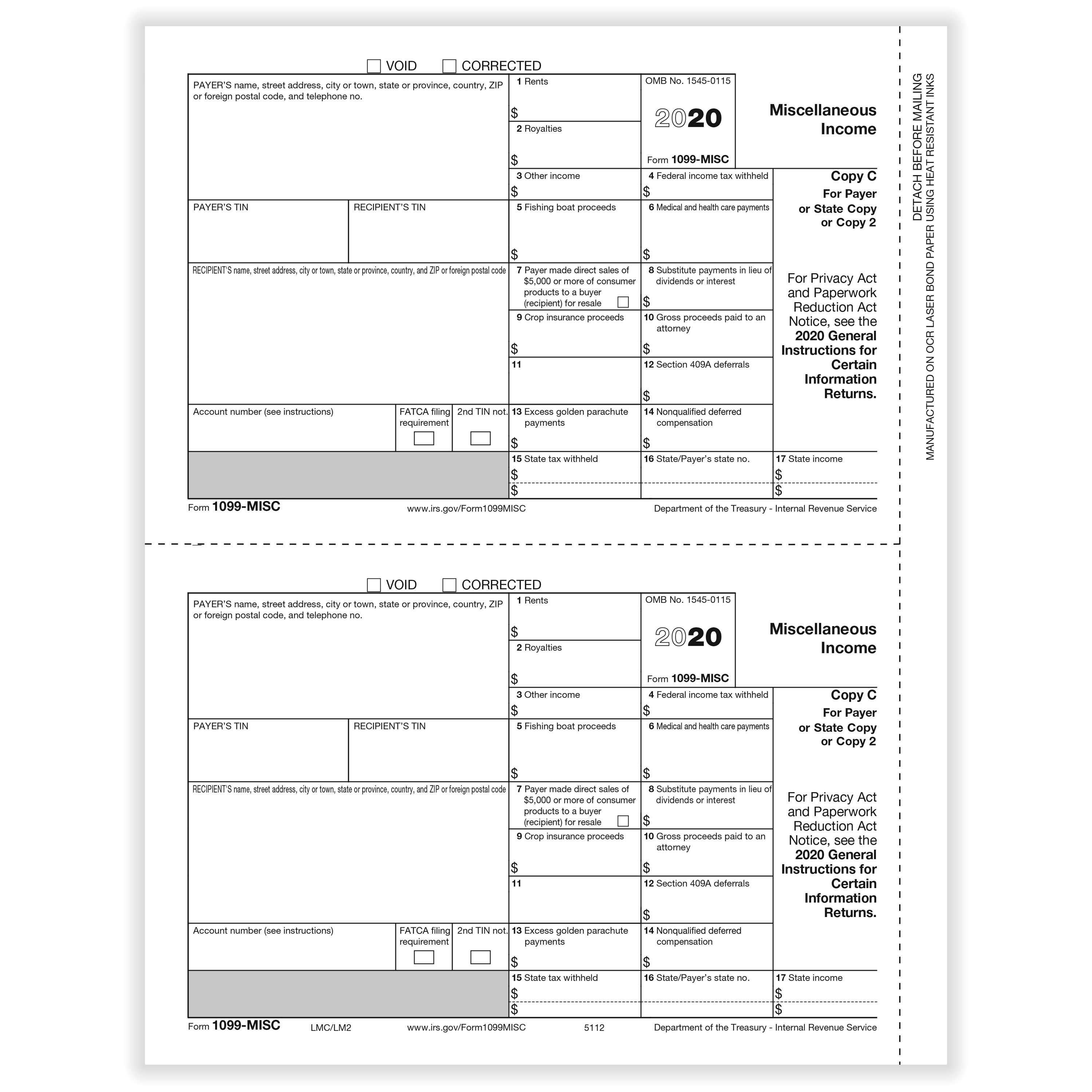

If you received a payout of over $600 in a given year from a business, you should have received a 1099-MISC. Types of income include prize money, gross proceeds payments to attorneys and rental payments for space or equipment. Form 1099-MISC was previously also used to document nonemployee compensation, but this was discontinued in 2020 when Form 1099-NEC was reintroduced. Explain it on your tax return if you disagree with the information on the 1099 form but you can’t convince the payer you’re correct. Suppose you received a $100,000 payment from your car insurance company to cover your medical expenses and pain from a whiplash injury you suffered in an accident.

responses to “What is an IRS 1099 Form? (Definition & Form Differences)”

- Each type of 1099 form is an informational return meant to notify the IRS of any income outside of W-2 earnings.

- Payments from the federal, state, or local government of $10 or more for credits, refunds, or offsets are reported to the IRS using Form 1099-G.

- They are used to inform the taxpayer how much money was received from a payer.

- However, it is important to note that the payer or employer should still keep records of the reimbursed expenses and may need to report them separately to the IRS.

Every Form 1099 includes the payer’s employer identification number (EIN) and the payee’s Social Security or taxpayer identification number. The IRS matches nearly every 1099 form with the payee’s tax return. Tell the payer immediately if you receive a 1099-MISC on Jan. 31 that reports $8,000 worth of income when you were only paid $800 by the company. There may be time for them to correct the form before sending it to the IRS. The IRS will send you a letter or bill telling you that owe taxes on the income if a company submits a 1099 form to the IRS but you don’t receive a copy for some reason so you haven’t reported that income. This letter might not arrive promptly so it’s important to remember that you’re responsible for paying the taxes you owe even if you don’t receive the form.

What is a 1099 form used for?

In other words, if you freelanced, were self-employed or had a side gig, your clients should send you a Form 1099-NEC instead of a Form 1099-MISC. As always, you’ll use the information on that form to prepare your tax return. The IRS requires individuals, small businesses, companies, financial institutions and others to report money or bartered value of a service or commodity as income each tax year. The 1099 is an information form, not a tax return, and there are different versions that cover a wide spectrum of payment situations.

If you still haven’t received your documents either by mail or electronically, reach out to the issuer for assistance. Noncitizens who live outside the US receive a version of this form called an SSA-1042S. The SSA-1099 and SSA-1042S aren’t distributed to people who currently receive Supplemental Security Income (SSI). If you sold real estate that appreciated in value, this difference is subject to capital gains tax. When you purchase a bond for less than its face value, that’s called an original issue discount. You’ll redeem the bond at its face value when it matures, and the IRS considers the difference between the two to be taxable income.

Unlike traditional employees, those with 1099 jobs have different tax reporting requirements. They’ll also generally not receive benefits like healthcare or paid time off, as these are managed independently instead of by an employer. When running a business, you may hire both employees what are 1099s and independent contractors, so it’s essential to understand the differences between 1099 forms and W-2 forms. To comply with IRS regulations, businesses must send 1099 forms to vendors by January 31. Send Copy B to the contractor for their tax filing, and retain Copy A for your taxes.

The Taxpayer Relief Act of 1997 gives many homeowners relief from this tax liability. If the home you sold was your primary residence, and you lived in it for at least 24 months, you are exempt from the first $250,000 of the gain ($500,000 if married and filing jointly). If you’re on contract with a company but not a full-time employee, and you’re being paid based on contract terms, you should expect a 1099-NEC, according to Taylor. An accelerated death benefit is when a life insurance policyholder receives their benefits before death because they have been deemed terminally ill by a doctor. This benefit is intended to help cover medical costs and make the policyholder comfortable. There are legislative efforts to make this program permanent, but negotiations are stalled in the US Senate as of this writing.

All 1099 forms must be filed with the IRS and postmarked to recipients by January 31st. Remember, non-employee compensation is no longer reported on Form 1099-MISC as of 2020 and is reported using Form 1099-NEC. As of 2020, the IRS reinstated the use of Form 1099-NEC to report non-employee compensation that had previously been reported using Form 1099-MISC. It’s different than other kinds of 1099s you might get in the mail. The 1099-MISC is a common type of IRS Form 1099, which is a record that an entity or person — not your employer — gave or paid you money.

This is the form that independent contractors receive from those who have paid them. If you work as a freelancer, you will receive a 1099-MISC form showing what you were paid. However, if a payer hasn’t paid you at least $600 in the past year, you might not get a 1099-MISC – but you still have to report your income. For a comprehensive list of types of 1099s, click on our “What is a 1099 Form? The payee must then report that income on their tax return, where it will be matched with IRS records. For a variety of reasons some Form 1099 reports may include amounts that are not actually taxable to the payee.

If a business intentionally disregards the requirement to provide a correct 1099 form, it’s subject to a minimum penalty of $660 per form or 10% of the income reported on the form, with no maximum. The due date for producing 1099-NEC forms is on or before Jan. 31st. You must provide a Form 1099-NEC to each contractor and to the IRS by that date. Many businesses e-file, and e-filing makes it easier to meet the filing deadline. Once you’ve determined who your independent contractors are and you feel confident your books are in order, you can begin completing a 1099. We’ll walk you through this step by step so you can ensure proper taxation.

If you got distributions from a pension, retirement plan, profit-sharing program, an IRA or an annuity, you might receive a 1099-R. Income that’s been reported on a 1099 is typically taxable but many exceptions and offsets can reduce taxable income. Let’s say a taxpayer has a gain from the sale of a home because the selling price was higher than the original cost basis. The taxpayer might not owe taxes on that gain because they may qualify for an exclusion of up to $250,000 of this money depending on their tax situation. Form 1099-SA form is sent to individual taxpayers who receive distributions from health savings, medical savings, and Medicare Advantage accounts. Reimbursed travel expenses are not considered income if they are paid under an accountable plan.